In 2023, all those people with a gross salary less than 21,000 euros they will be able to enjoy a drop in personal income tax. And the blocks for which the tax goes up have also changed. For this reason, whether we want to use the Treasury as a “savings fund” by paying personal income tax (not recommended, by the way), or if we want to lower the personal income tax to have a little more liquidity month by month, we are going to calculate it from the website of Tax authorities.

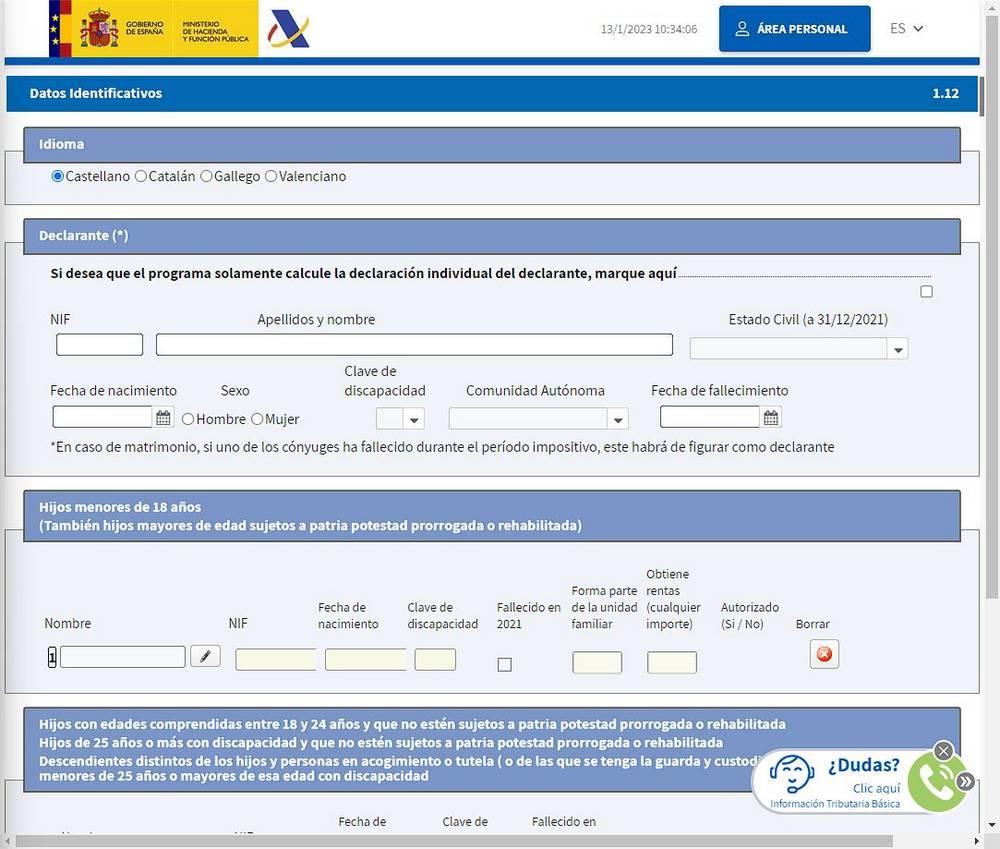

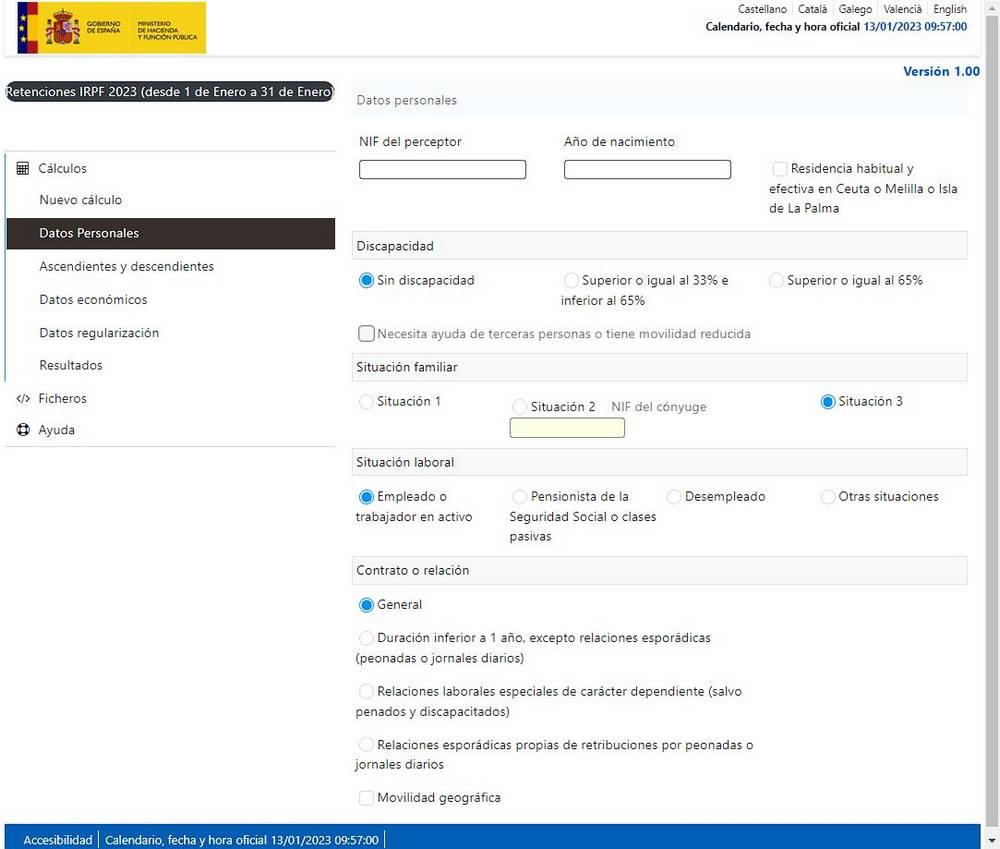

To do this, the best way is to directly access the website of the Tax Agency. There we will have to fill out a simple form with our data. In the first window we will have to fill in:

- Personal data (ID, year of birth, residence).

- Disability (degree, and if we receive help).

- Family situation.

- 1: single, widowed or separated with children under 18 years of age.

- 2: married, with a partner who earns less than 1,500 euros a year.

- 3: other family situations.

- Employment status (employee, pensioner, unemployed, others).

- Type of contract.

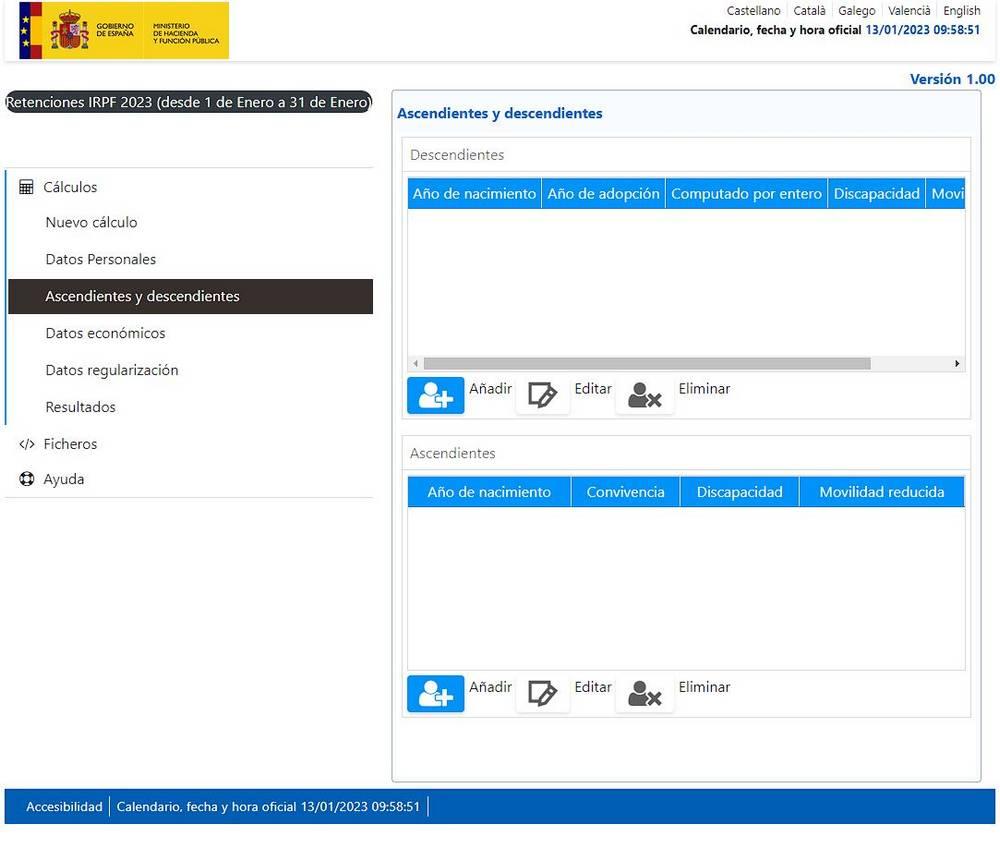

In the next step, what we will have to do is enter the data of the relatives, both in the ascending and descending branches. If we have children, for example, we must enter their data in the first box, in the same way that if we are in charge of the parents we will put it in the second box.

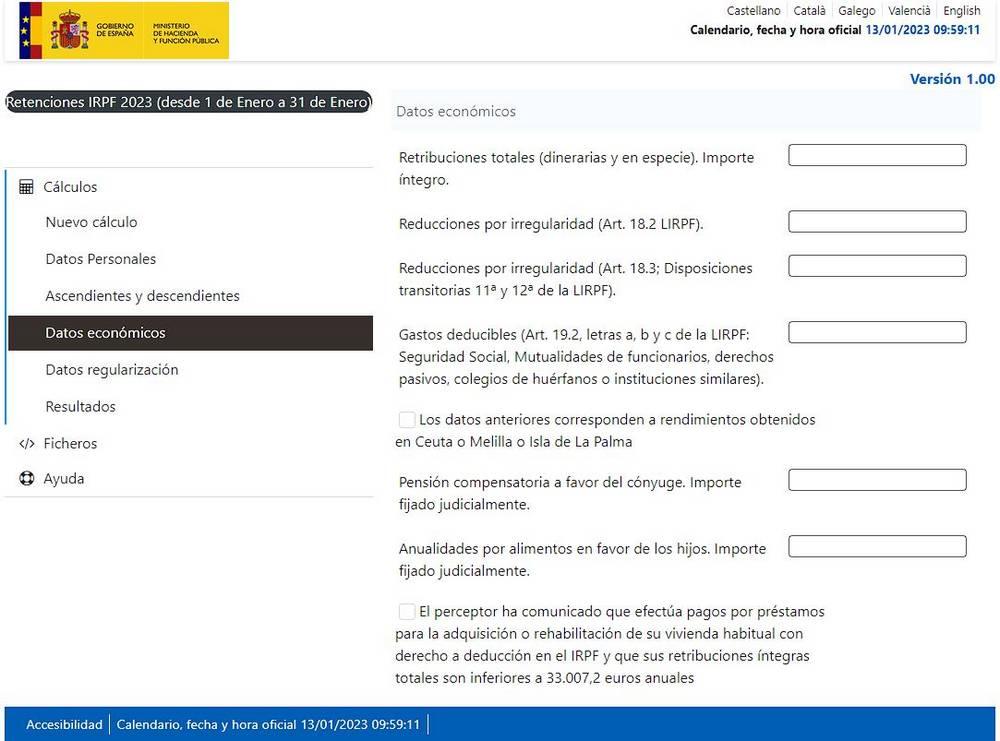

The third section corresponds to economic data. This is probably the most complicated part of the process, since there is a lot of data that we can enter and that can make our tax vary.

The important thing is to indicate to the calculator our total remuneration (gross salary), deductible expenses (for example, union dues or social security), and if we pay compensatory pensions. It is necessary to have the payroll on hand for these data, or also the draft of the income statement of the previous year if the situation has not changed.

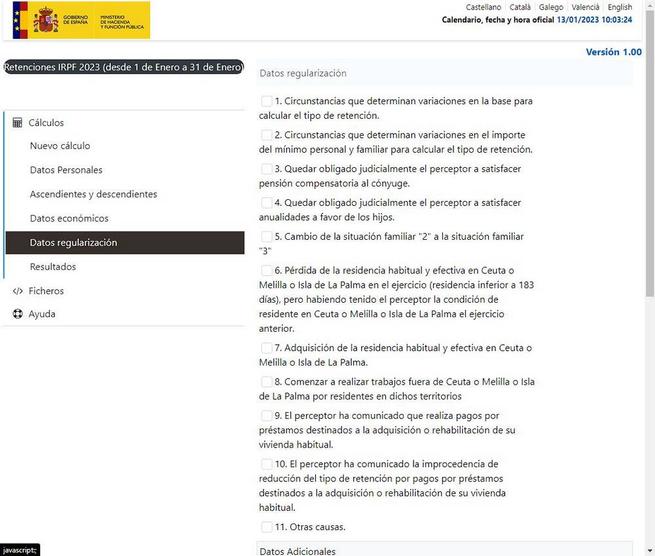

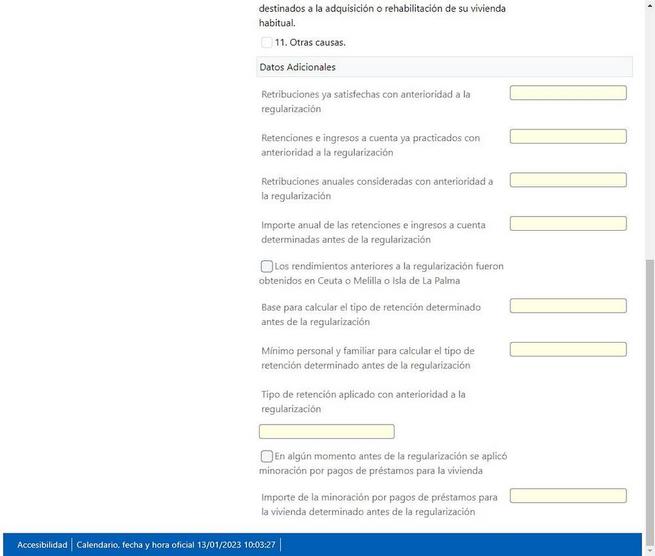

And, finally, we must review the regulation data to indicate to the Treasury of possible changes that we have had recently.

With all this data already entered, we finally click on “Results” and we will be able to see what is the rent that we are going to have to pay throughout the year. We must bear in mind that these data correspond to the current year (2023, right now) and the income statement that we are going to make in April corresponds to the previous year (2022 in this case), so this calculator is not useful for us to see how much are we going to have to pay this year, but how much we will have to pay in next year’s rent.

WEB Open Income Simulator

When the time comes to file the income statement, we have two options. The first is to pay an agency to do it for us (recommended if we operate on the stock market or have personal situations) very strange, or the second, to do it ourselves with the simulator.

Until a few years ago, it was not easy or intuitive to file the income statement online (many of us still have nightmares about DAD (Income Declaration Aid Program)). However, with the advent of the well-known Renta Web program, checking and presenting it should not take more than half an hour.

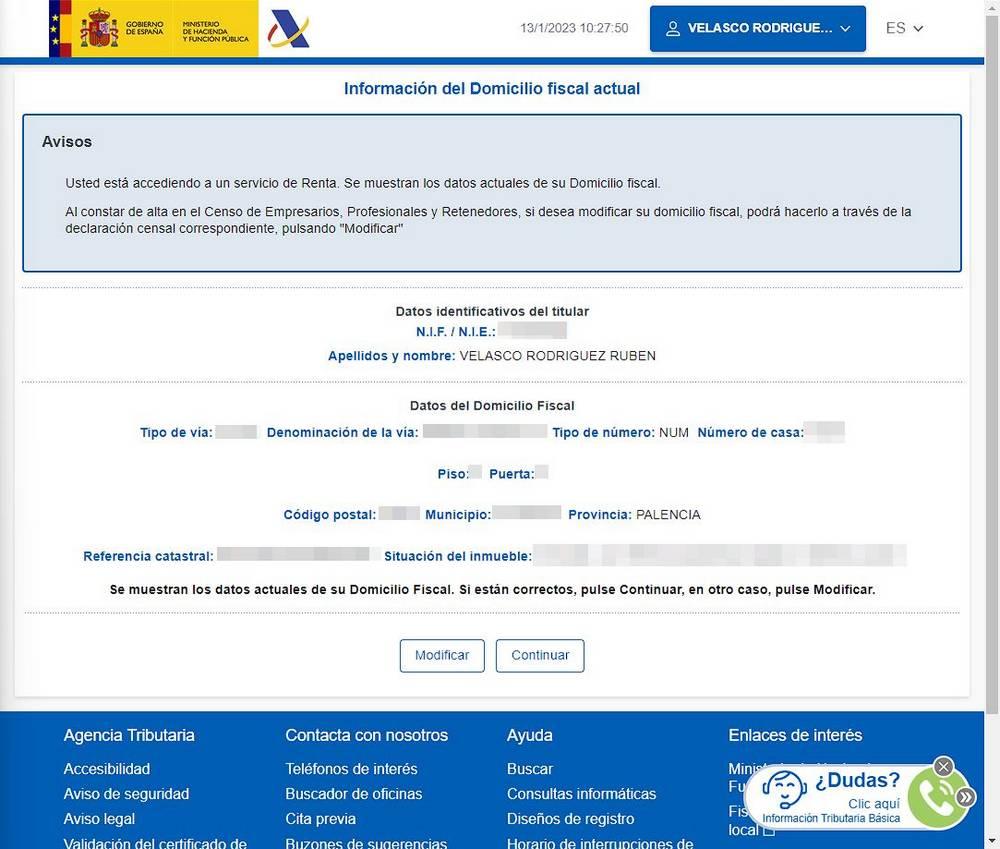

This program is responsible for loading the draft of our declaration, the one made by the Treasury, and shows us a summary with the data it has about us. To do this, the first thing to do is check our tax data so that we can make sure they are up to date. In case there are any modifications, we will have to modify them.

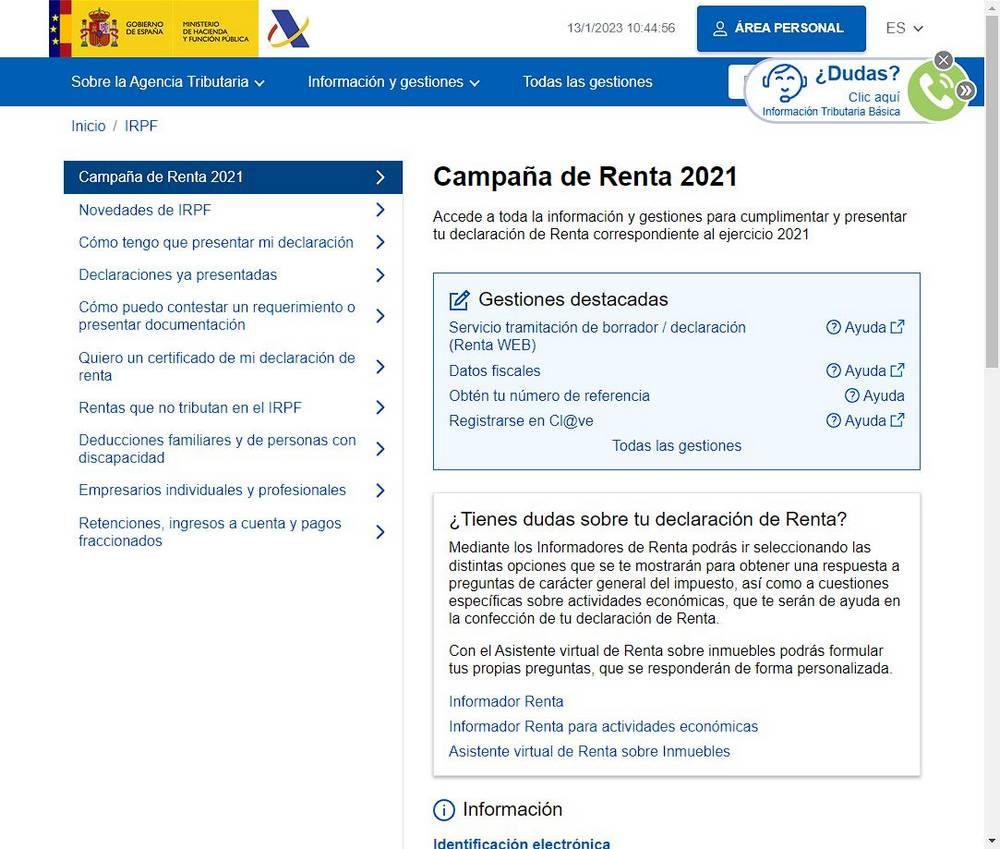

To start with the rent draft, we must access this link. There we will find everything necessary to be able to carry out the Income campaign.

In the event that there is any change in our family or personal situation, we can take the opportunity to modify the data from the section «tax data«. It is also useful to see all the data that the Treasury has about us, and it will help us to make calculations to see if the draft is correct or incorrect. We will enter with our certificate or ID, and we will be able to see a summary like the following.

With the “Modify” button we can change this data to match reality. If not, with the “Continue” button we can see a summary of all our tax data.

Once this is done, returning to the previous section of the income campaign, we click on «Draft / declaration processing service (Renta WEB)» to open the income calculator and start making our statement.

If we do not want to use the processing service (although nothing will happen as long as we do not process and sign the declaration), we can also access the Income simulator. In this way we can have the peace of mind that nothing we calculate will cause us problems, as it is a simple simulator with no possibility of presenting anything.

VAT and personal income tax calculators

Apart from the tax calculators from the Treasury (which are rarely updated), we can also use other programs that will help us calculate our taxes and how much we are going to have to pay (or request a refund from the Treasury).

From the phone

In addition to the previous web calculators, which we can access from any operating system, we can also find apps specially designed for Android and iOS that help us calculate all kinds of taxes.

For example, one of the most complete that we can find in the Play Store for Android is Income Tax Calculator. This app allows us to calculate the IRPF tax quota in Spain in a very simple way. Perfect to anticipate the Treasury campaign and prepare the portfolio in case we have to pay.

If we usually work with invoices and VAT, this VAT Invoice Calculator IRPF It is another of the apps that is always good to have on hand. With it we can calculate the net base, the tax base and all taxes based on the percentage of VAT and personal income tax.

From the web

Although the most recommended method for calculating income tax and taxes is the tax calculatorwe can also find other tax calculators on the web that can help us better calculate what we have to pay.

For example, the first calculator of this type from Contasimple. This calculator is very useful to calculate the VAT of an invoice and the corresponding IRPF withholding, in case it is affected by this withholding. In this way, if we are self-employed and invoice with VAT, we will save ourselves trouble.

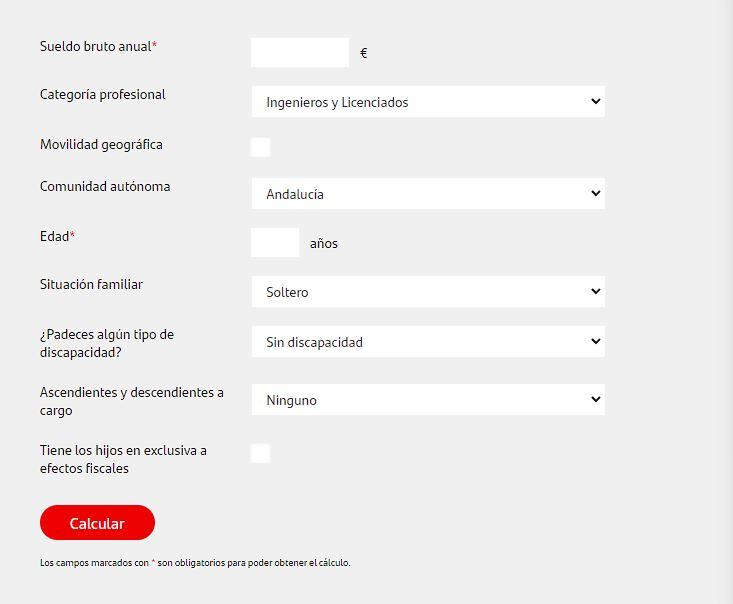

Banks also have their own tax calculators. For example, at BBVA we can find a net salary calculator, very useful to find out how much money we will have left after the withholdings that are applied to us based on our situation. And we can also find another similar calculator at Banco Santander. Thus, depending on our personal situation, we can find out what is the amount of personal income tax that we have to pay. And this bank also shows us a net salary calculator.

with programs

Finally, if we have a lot of activity, and we want to control all our expenses to avoid getting upset, we can resort to the accounting programs much more professionals, who will automatically be in charge of keeping track of all our expenses.

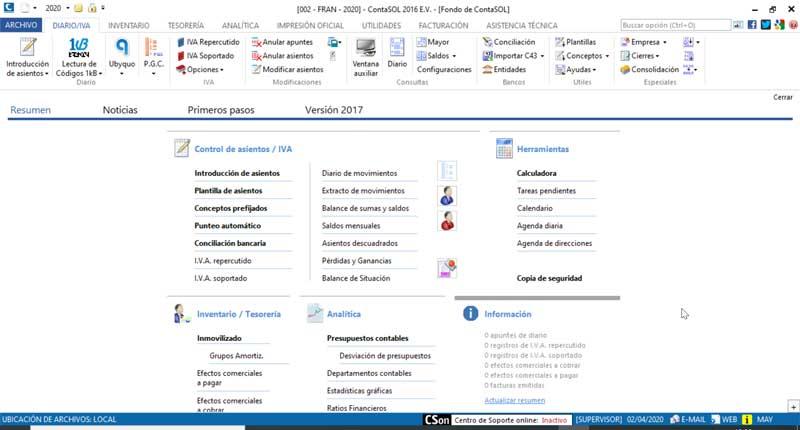

contasol

One of the best known is Contasol. This software has everything necessary to keep both our personal accounting and the accounting of various people, and even of a company. It is a free program, although with some paid features, such as automatic updates and support. The most important thing is that it is updated with data from the Treasury, so taxes and models are always up to date.

vision win

This program is committed to a business model similar to the previous one, that is, it offers us a free program with which, if we want support or updates, we have to pay. It has a very simple and intuitive interface, and allows us to centralize all our accounting in a single place. It even has very interesting functions for users such as the possibility of scanning invoices, so we can forget about filing and physically saving them.

contasimple

This is another of the best known and used programs in accounting. It is a software that we can run in the cloud and for which we also have Android and iOS applications, being able to always have our taxes at hand. It has a free plan, very limited, and then several paid plans so that we can adjust the price based on our needs.