In these times we must look for all kinds of aid or elements that we can deduct in order to maintain our economy afloat, unless they help. That is why in many cases we have the possibility of carrying out this type of movement in our income statement if we rent or have a mortgage.

This is something that for a long time we can carry out annually when we make our income statement. If we take into account how the general economy of most people is right now, this type of tax relief will surely not hurt almost anyone. Along these same lines, we want to focus on two of the most common situations and those in which most of us find ourselves immersed.

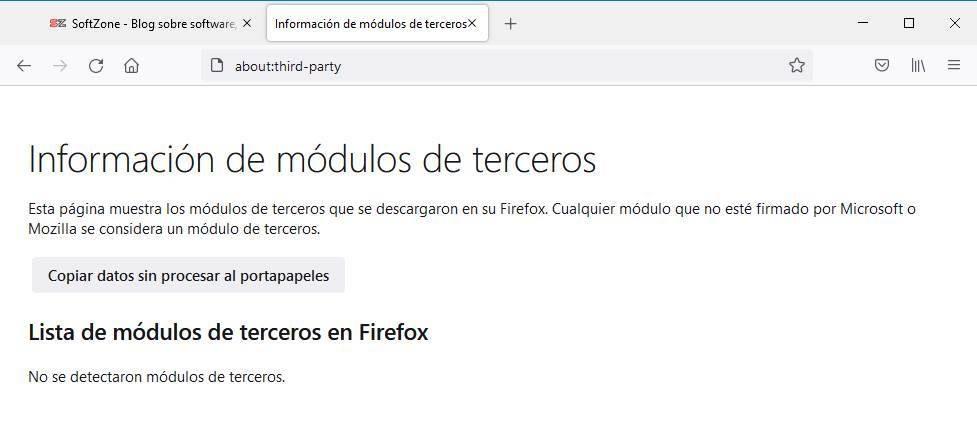

Specifically, we refer to the possibility of deducting part of the rent where I live or the mortgage on my house. This is something that most of you can carry out when you make the income statement, but yes, we must bear in mind that for this we must meet a series of prerequisites. For this reason, below we are going to talk about the possibilities you have of deducting taxes, either the rent or mortgage on the statement of incomewhether we do it in person, or through the Internet in the browser.

In the event that you meet the requirements demanded by the Treasury, you will be able to make all of this effective and thus save money in a few months.

Requirements to meet and deduct the rent

We are going to start with the possibility that we live for rent and we want to deduct the same in the next Treasury statement. As we mentioned before, for all this we will have to meet a series of requirements that we will precisely describe below. The first thing we should know is that each autonomous community applies deductions to rent depending on personal circumstances. But in all of them we must take into account the following in a common way:

- The age deductions they are applied to those under 35 years of age with deductions that can range from 10% to 30%.

- Whether share a flat each taxpayer can deduct what is paid individually per month as part of the total.

- To deduct the rent, the contract must be registered in the settlement office of the corresponding autonomous community.

- In addition, the required deposit must be deposited in the corresponding Housing Institute.

- The maximum base of the deduction it is 9,040 euros per year if the tax base is equal to or less than 17,707.20 euros.

How can I deduct my mortgage?

Something similar happens among all those who currently have a mortgage and want to deduct it in the next income statement. Next, we will see the basic requirements that must be met for all this.

- It is essential that the mortgaged home be our habitual residence.

- You cannot deduct a holiday apartment or a flat to rent to other people.

- Likewise, it is essential to have bought the mortgaged home before January 1, 2013.

- To this date we must add that we must have applied the deduction to deduct the mortgage in the year 2012 or earlier.