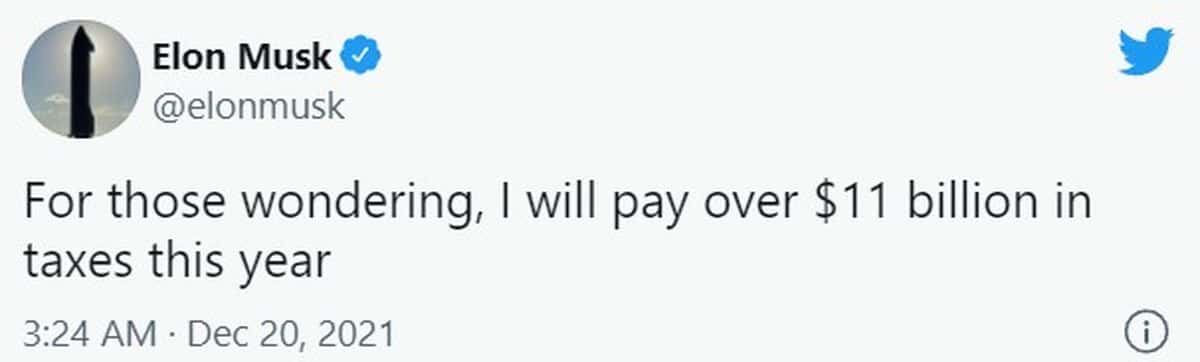

Elon Musk will pay $ 11 billion in taxes for the year 2021. A tidy sum. It is he himself who affirms it in a tweet. As a reminder, the boss of Tesla and Space X is currently the richest man on the planet.

No one has paid so much tax in the history of the United States, he said. Elon Musk will indeed discharge an 11 billion dollar bill for this year. It is he who affirms it in a tweets, while speculations on the amount were rife.

11 billion dollars is obviously a colossal sum, an extraordinary amount that makes you dizzy. But for Elon Musk, this is only a very small part of his fortune. The latter is estimated to $ 255 billion.

“For those who were wondering, I will pay $ 11 billion in taxes this year”

Elon Musk must pay $ 11 billion in taxes

“Those Who Wondered” actually refers to Bloomberg. The American financial group had tried to calculate this amount. He came to the conclusion that Musk should pay just over $ 10 billion in taxes. Well seen.

A few months ago, Elon Musk carried out a poll on Twitter, asking his followers if he should sell 10% of his Tesla shares to pay his taxes. The vote ended with a yes, and Tesla’s CEO then kept his promise, selling his assets and raising $ 13 billion. Elon Musk said in a discussion with Senator Elizabeth Warren that he was the most taxed American in US history. Indeed, no one will ever have paid as much tax as him.

Read also – SpaceX could soon go bankrupt, according to Elon Musk

However, a report from ProPublica pointed out that Musk actually paid little tax in view of his wealth. The businessman receives no salary from Tesla or SpaceX, and therefore pays little income tax. As of this writing, Elon Musk is the richest man in the world with an estimated fortune of $ 255 billion. He is followed by Jeff Bezos, the former boss of Amazon, and by the French Bernard Arnault.