About a week ago we told you that semiconductor orders had started to fall, and we saw that TSMC could be one of the companies most affected by this unexpected turn of events. It has been quite a surprise, really, since we have gone from suffering a significant shortage of semiconductors to finding ourselves with a notable drop in orders, something that according to a report published by TrendForce, could lead to underutilization of productive capacities of the main players in the sector, including TSMC itself.

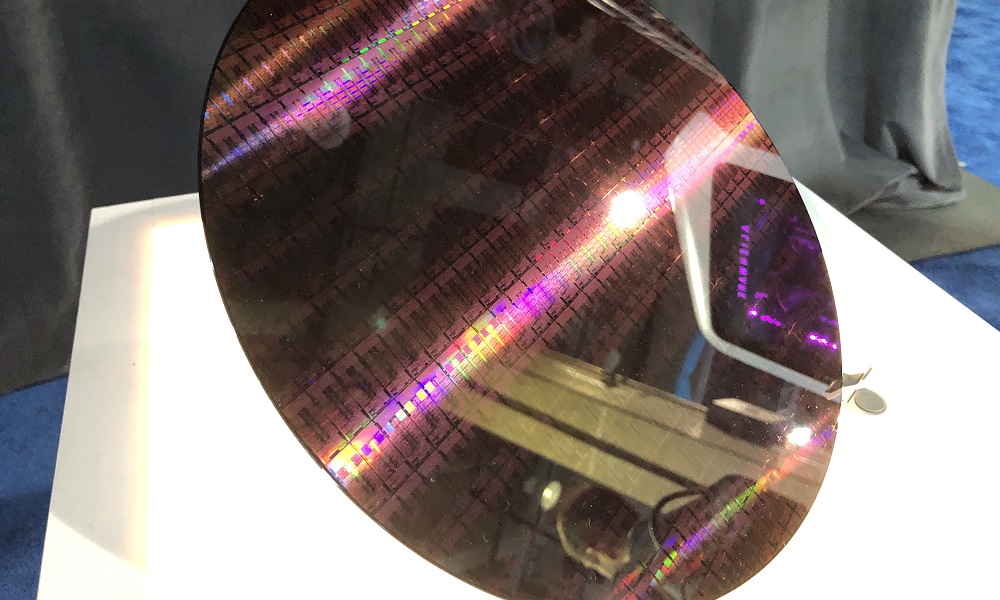

This report is very clear, and at the same time very interesting, thanks to the table that TrendForce has shared as a summary. In it we can see that the 8-inch (200 mm) wafers would be the ones with the greatest degree of underutilization of production capacity by the end of this year, with a usage rate between 90% and 95%. These types of wafers are used to produce a large number of variants of semiconductors, but they do not have applications in really advanced chips, since they are used for nodes of 0.3 and 0.11 micrometers (or microns).

12-inch (300mm) wafers have a greater number of applications, being used to produce semiconductors on nodes ranging from the “old-timer” 90nm and 55nm to the more current 7nm, 6nm, 5nm and 4nm The TrendForce report has made a grouping by categories where we can see that nodes between 90nm and 55nm would have a drop to between 90% and 99% usagewhile the nodes between 45 nm and 28 nm could also drop at rates of 90% to 99%, although in this case it is noted that they have increased potential risk of falling.

18nm, 16nm, 14nm, 12nm and 10nm nodes could be stable or drop at 95% usage rate, and the same could happen with nodes between 7nm and 4nm. The latter is something very curious that, in fact, fits with the information that we have been giving you, and that points precisely in that direction, in a significant reduction in orders for semiconductors that would be affecting all sectors, including from the world of automobile, which normally uses “old” nodes to obtain the chips it needs, to the advanced semiconductor sector, such as SoCs, CPUs and GPUs, which must be manufactured in advanced and/or next-generation nodes, such as those of 7 nm, 6nm, 5nm and 4nm.

If all goes according to plan, it is very likely that by 2023 the utilization rate of certain production processes will have dropped so much that a reallocation of resourcesAnd yes, we will have said goodbye to chip shortages altogether, at least for now.