Given the important impact that the shortage of chips is having on the different European industries, the Chip Law seeks to eliminate this dependence on Asian manufacturers. However, analysts question whether this measure meets the needs of providers or if it comes too late.

The least optimistic forecasts for chip shortage are still fulfilled. Despite the fact that some sectors are better weathering this crisis, the truth is that others, such as the automobile sector, are going through one of their worst moments.

Car manufacturers Europeans did not stock enough chips from their suppliers, mostly based in Asia, at the height of global demand. This and other factors have caused factories to close and fewer new cars to hit the market.

Without a doubt, this sector exemplifies the serious consequences that the shortage of chips is having, how dependent suppliers are on semiconductor manufacturers in Asia, with the vast majority of chips produced by TSMC in Taiwan.

Among those who want to recover part of that market share is the European Commission (EC), which in February announced a chip law.

The EC will invest 43,000 million euros, combining public and private investment, in the European industry of semiconductors. The Commission hopes, among other things, to increase the region’s share of global chip manufacturing from less than 10% to 20%.

The Spanish government will invest 11,000 million euros to promote the development of chips

In addition, to this initiative is added the announcement by the Spanish government of a PERTE (Strategic Project for Economic Recovery and Transformation) that contemplates investing 11,000 million euros to promote the development of chips.

But can Europe really catch up with the rest of the world? And could this mean that the European Union car industry, the world’s second largest, will be protected from future supply shocks in the long run?

The shortage of chips from the prism of production

First of all, it is worth noting that the EU is not only far behind in chip production, but also has to compete with large investments elsewhere. For example, China invested $33 billion in its chip manufacturing industry in 2020. And South Korea also plans to spend almost half a trillion dollars through support packages, tax incentives and other measures over the next decade.

For Europe and the United States, which is also seeking to increase its market share in this sector, to truly compete, large sums of money are required, both from public and private sources.

The problem is that Europe is behind on multiple fronts, not just chip manufacturing. There are also relatively few companies within the EU designing new chips for use in technology products. Something that contrasts with the United States that has an important industry of semiconductor design.

Chip production capacities in Europe face competition with much lower costs

Also, while Europe has some production capacity for 300mm wafers, it lags far behind the US and Asia. So what kind of chips should Europe try to produce?

In theory, Europe could try to improve its ability to produce the oldest and largest chips. But this strategy would also not be easy to pull off due to equipment limitations and the fact that many countries around the world, including those with much lower costs, are trying to do this right now.

In addition, the chip landscape has yet to begin to sort itself out, and according to Gartner, there will be a global surplus of chips again in about two years.

So it’s not that Europe can’t improve its position in the semiconductor industry, but analysts say reacting to this chip shortage by trying to boost manufacturing alone would be neither an easy nor a smart move.

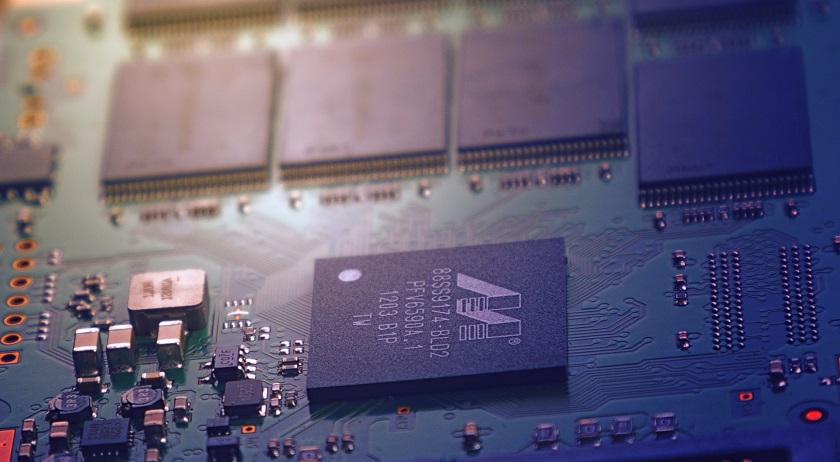

Initial image | Johannes Plenio