Bnext, Revolut, Vivid… today we can find a large number of neobanks In the net. A neobank, or online bank, is nothing more than a new generation of financial institutions that work intermediately with other larger banks, focusing, above all, on digital. The savings in personnel and offices allows them to offer users the possibility of withdrawing money from any ATM without commissions, not charging for maintenance, and even offering rewards, in the form of cryptocurrency tokens, depending on how the card or account is used.

Opening an account in a neobank is a matter of seconds. All you have to do is download the application, install it, and follow a few simple steps to register and open your account. We will have to send them a photo of the DNI, as well as record a selfie to show our personality. As soon as the account is created, we can start operating with it.

Everything looks very nice, and they even give us an IBAN account number with which we can make transfers, direct debit a payroll and even direct debit receipts and invoices. We can use a neobank as if it were a normal bank (since, generally, being linked to a real bank, they have a money guarantee of up to 100,000 euros).

But, overnight, and for no apparent reason, everything can turn black.

This is how Vivid notifies you of an account closure, without giving explanations

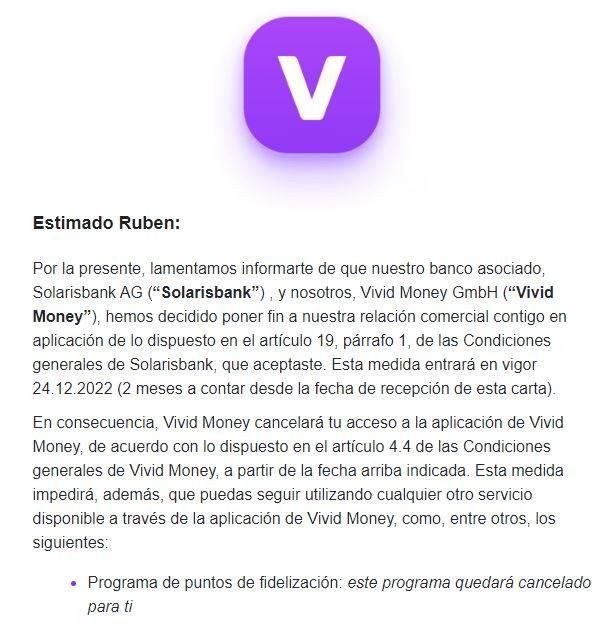

Just yesterday I received an email, by surprise, in which I was notified of the closure of the Vivid account, one of the neobanks that I use to withdraw money without commissions and make some online purchases.

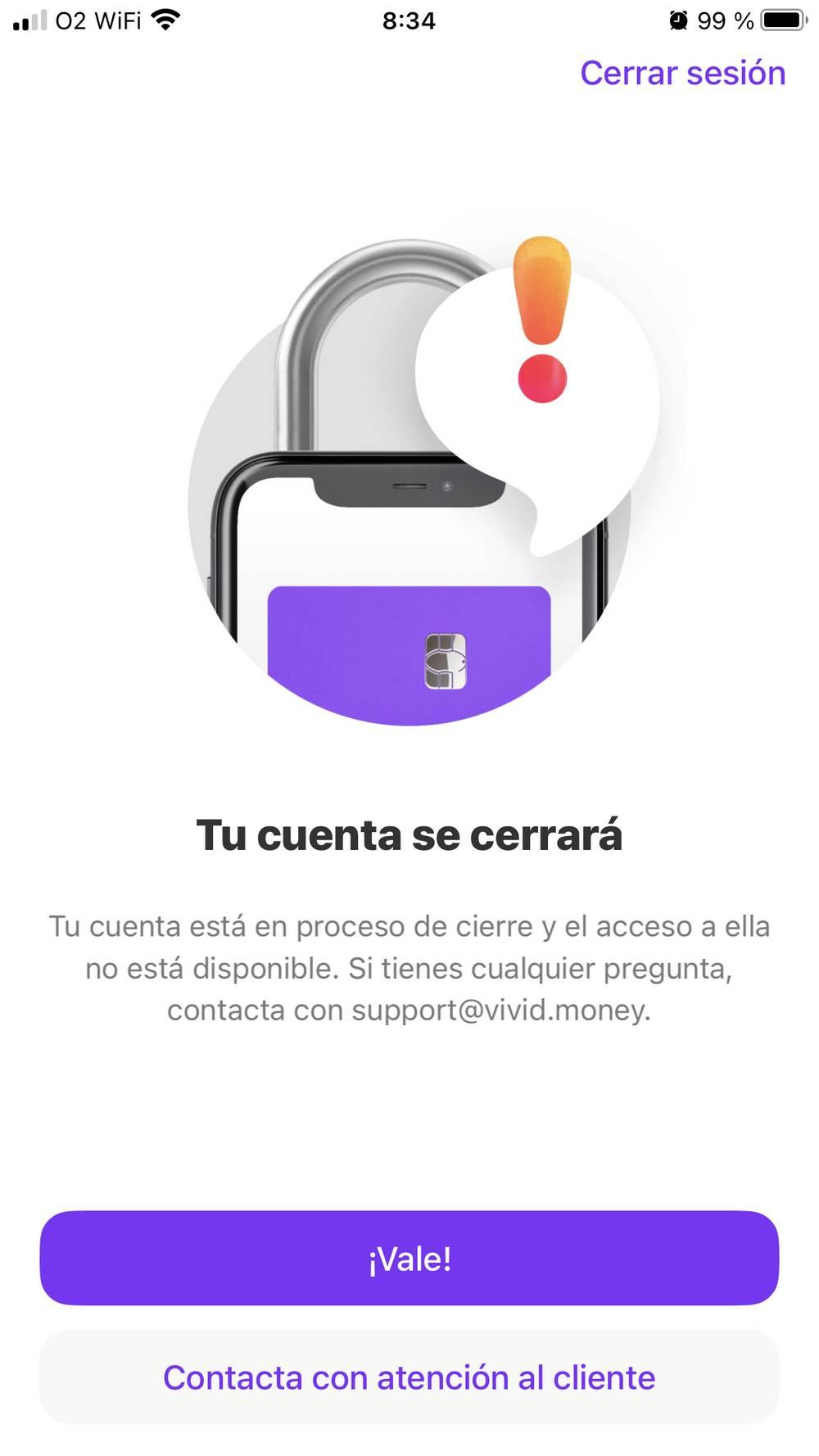

The first thing I thought was that it could be a phishing, or a scam, and the first thing I tried was to enter the app to check that everything was correct. What was my surprise to see that the session had been closed, and they would not let me enter the app because my account had been marked to be closed.

Investigating, I have found that article 19, paragraph 1, of the general conditions that I accepted at the time is “Bank resolution rights”, specifically “Termination with notice«. This means that the bank, at any time, and without explanation, can close your account. We can see it here. Article 4.4 of Vivid, in this case, supports the bank’s decision stating that «The customer’s right to access the Vivid Services will cease when Solarisbank or the customer has terminated their business relationship.»

What happened? It is not known. It may be that the card has been used too much, obtained many discounts thanks to the loyalty plan, and finally they have decided that I am not profitable. Or the opposite, a very sporadic use has made it not a valuable object for the bank, or for Vivid, and that is why they have closed the account. I may even have been the victim of a computer attack and the account has been used, in my name, for any type of illegal activity. Be that as it may, it is impossible to know, since they have already blocked access to the account.

I have tried to contact customer support, to be able to shed some light on this subject, without success. The button to contact directly does not work.

And what about the money?

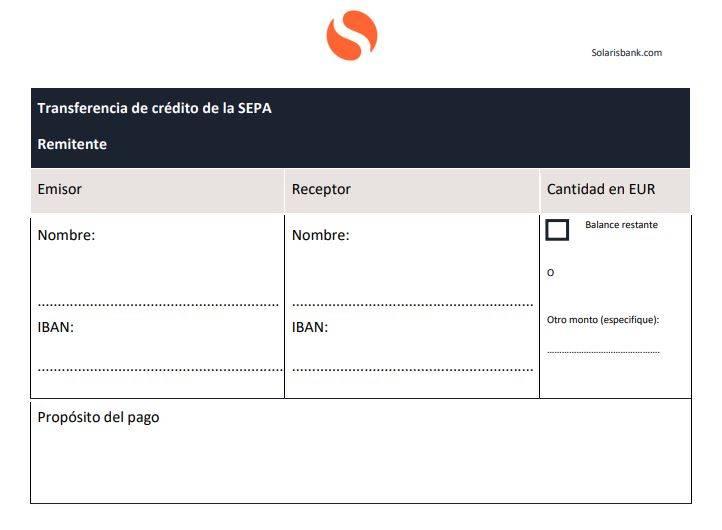

In my case, the account was empty; Except for a few cents remaining from some operation, he had no money saved in it. And less bad. But the first attempt of the bank, and of Vivid, is to keep the money, since they do not allow you to access the app in any way. In the email comes a PDF form that we must fill out if we want to transfer the balance of the account to another account of ours. Of course, we can already prepare to have problems. Who is the issuer? What is the account number? We don’t know any of that without being able to access our account.

If we manage to fill it, we will have problems. And, in the hypothetical case that we complete the process, namely the time it takes for the remaining balance to arrive in our account. That, taking into account that it really arrives, and that all of it arrives. Of course, the money in the form is only for the balance of the account. The cryptocurrencies, the tokens, the loyalty points and other money (that was not a current currency balance) that was in the account, we can forget about that. Or, at least, they don’t indicate how to recover it.

Does this mean that Vivid is a bad neobank? No. We just have to know what we’re dealing with when using this type of modern banking. After all, all these online banks depend on other larger banks, and the conditions are going to be practically identical.