In a new report, the prestigious market research firm Jon Peddie Research sheds real insights into the impact cryptocurrency mining has had on GPU sales since the beginning of this year. It goes without saying that AMD, NVIDIA and their assembly partners have benefited greatly from the high demand for the best graphics cards, but let’s look at the data from the report before drawing conclusions.

More than 25% of the GPUs sold were for mining

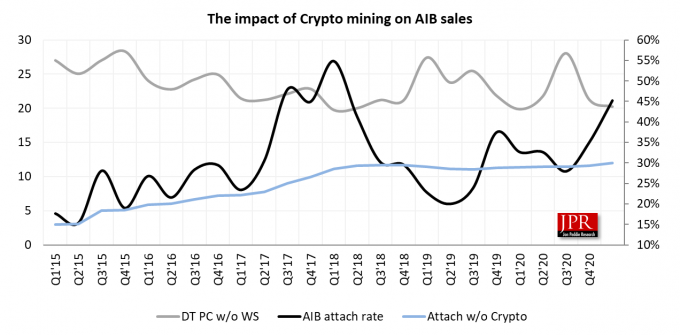

The consultancy estimated that 25% of graphics cards sold during the first quarter of 2021 passed into the hands of cryptocurrency miners and speculators. That corresponds to approximately 700,000 high-end and mid-range graphics cards designed for gaming, and in monetary terms we are talking about a sum of about 500 million dollars.

Jon Peddie Research, which has tracked AIB shipments since 1985, noticed a substantial drop in the AIB-to-PC connection rate; the firm observed that the attachment rate dropped to 25% before finally recovering to 50%. Then JPR used a simple formula where AIB mining usage is equivalent to the difference between the trending normal connection rate and the existing connection rate.

The company assumes that professional cryptocurrency miners have their dedicated settings and buy these graphics cards to use them in bulk. On the other hand, there are also the occasional miners who could invest in a full PC just to mine cryptocurrencies, and in any case the firm admitted that its forecasting model is not as accurate as before due to a shortage of components. We have already witnessed resellers and miners employing purchase bots to get their hands on graphics cards as soon as they are available in stores.

GPU price inflation on the rise

Cryptocurrency mining using the GPU is not the only reason for the drastic price inflation on graphics cards. The pandemic has also played a role in this situation, forcing many factories to temporarily shut down and disrupt supply chains in the process. Some of the components of graphics cards, such as GDDR6 memory chips or voltage regulators, are known to have also risen in price since the beginning of the pandemic and according to JPR, the increase is as high as 70% in the beginning of anus.

AMD and NVIDIA are essentially intact in the GPU benchmark hierarchy, but the two companies are taking different stances on cryptocurrency mining. For starters, AMD has already stated that it does not have any problem or will put any impediment to consumers mining on its RDNA 2 graphics cards. NVIDIA, for its part, has taken steps such as launching the line of dedicated CMP graphics cards to the mining of Ethereum and other cryptocurrencies, and at the same time has implemented mitigating measures to limit the mining performance of its gaming GPUs.

Despite the efforts of both manufacturers, or no efforts in AMD’s case, graphics cards are still out of stock everywhere. The few units manufactured are going on sale dropwise and at absurd prices (without going any further, well-known stores in Spain are selling GPUs at more than triple their price, with total impunity and without any remorse), to the point that some stores like the American Newegg have held raffles not for the GPUs themselves, but raffled for the right to buy a unit.

The second-hand market is even worse, with the Ampere and Navi GPUs selling for twice to three times their price. Simply put, it’s a bad time to buy a graphics card (at least for gaming).