The NASDAQ Composite Index, represented by the ticker symbol .IXIC, is a powerhouse of the stock market. Known for its concentration of innovative technology companies, the index serves as a bellwether for the health of the tech sector and the broader U.S. economy.

The .IXIC includes over 3,000 stocks listed on the NASDAQ exchange, encompassing tech giants like Apple and Microsoft alongside rapidly growing companies on the cutting edge of innovation. This unique composition makes the NASDAQ Composite a dynamic and influential index for investors and market observers worldwide.

In this comprehensive guide, we’ll explore what makes up the NASDAQ .IXIC, how to track its performance, and the strategies for incorporating it into your investment portfolio.

What is Included in the .IXIC?

While prominently known for its technology focus, the NASDAQ .IXIC Composite Index features a diverse range of companies that contribute to its overall performance.

Types of Companies

- Tech Giants: The index is home to established technology titans like Apple, Microsoft, Amazon, Google (Alphabet), Meta (Facebook), Tesla, and many others. These companies wield significant influence due to their size and market dominance.

- Growth Stocks: The NASDAQ has a reputation for attracting high-growth companies across various sectors, from disruptive biotechnology firms to innovative software developers. These companies often prioritize rapid expansion over immediate profitability.

- Beyond Tech: Although tech-heavy, the .IXIC includes companies from sectors such as:

- Healthcare: Pharmaceuticals, biotech, medical devices

- Consumer Services: Online retail, streaming services, travel

- Industrials: Companies involved in manufacturing and transportation

- International Companies: The NASDAQ exchange lists some foreign companies with American Depositary Receipts (ADRs), allowing them to be included in the index.

Must read: OnionPlay: Safety Check and Alternatives

Listing Requirements

To be included in the NASDAQ Composite, companies must meet specific listing requirements set by the NASDAQ Stock Exchange. These include:

- Exclusive Listing: Companies must be exclusively listed on the NASDAQ exchange’s Global Select Market, Global Market, or Capital Market tiers.

- Security Types: Eligible securities include common stocks, ordinary shares, Real Estate Investment Trusts (REITs), and tracking stocks.

- Governance Standards: Meet corporate governance standards, including having an independent board of directors and regular financial reporting.

Index Weighting: Market Capitalization

The NASDAQ Composite is a market capitalization-weighted index. This means a company’s influence on the index’s movement is proportional to its total market value (share price multiplied by the number of shares outstanding).

- Impact of Large Caps: Tech giants like Apple and Microsoft have a significant impact on the .IXIC’s performance due to their enormous market capitalizations.

- Rebalancing: The index is rebalanced quarterly to maintain accurate weighting representation. As companies grow or shrink in value, their relative weighting within the index is adjusted.

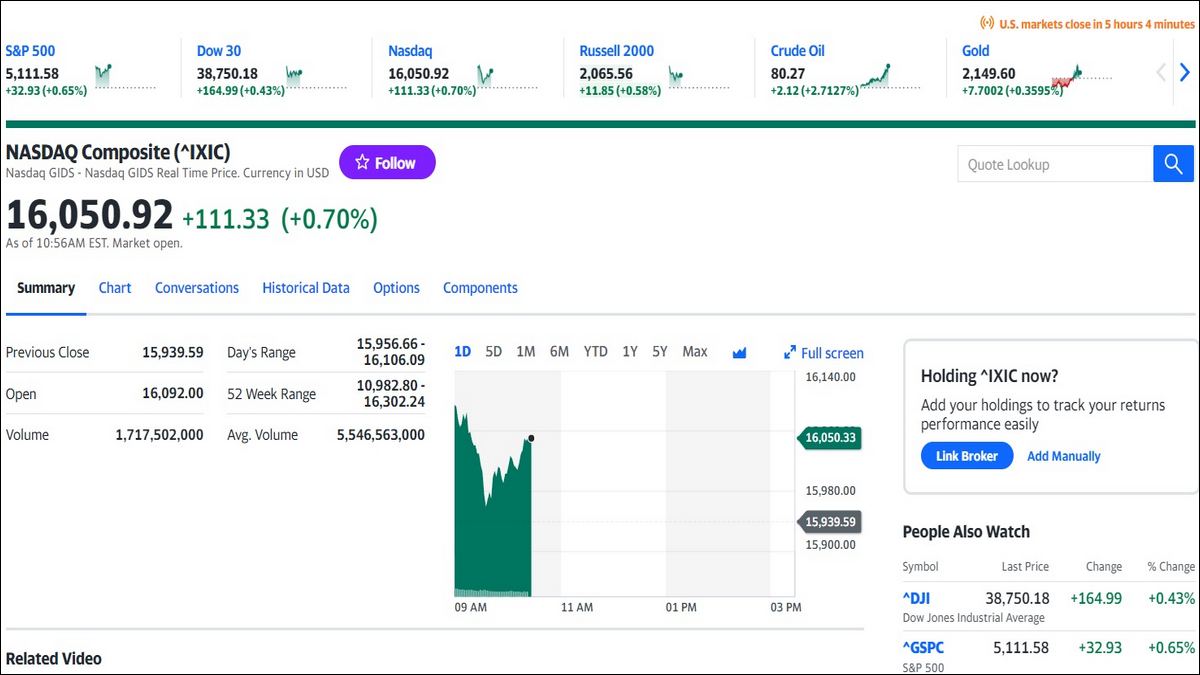

Historical Performance of the .IXIC

The .IXIC’s history is a story marked by both extraordinary growth and periods of volatility, reflecting the ever-changing dynamics of the technology sector and broader market.

Key Milestones and Trends

- Early Growth (1970s-1980s): The .IXIC’s inception dates back to 1971, and it steadily gained traction as personal computers and early tech innovators fueled its rise.

- The 1990’s Tech Boom: The internet revolution propelled the index stratospherically, with companies like Microsoft, Intel, and Cisco becoming household names.

- Dot-com Bubble Burst (2000): The frenzy of the dot-com boom came crashing down in 2000, sending the .IXIC plummeting as many overvalued internet companies collapsed.

- Steady Recovery and the Rise of the Tech Giants: The index gradually recovered over the following decade, driven by the consolidation of established tech players and the emergence of new titans like Google and Amazon.

- Recent Surge (2009 onward): Stimulated by low interest rates and a booming tech landscape, the .IXIC experienced remarkable growth fueled by advancements in cloud computing, artificial intelligence, and mobile technologies.

Comparison to Other Major Indices

- S&P 500: The S&P 500 represents the broader U.S. market with less emphasis on technology. It generally offers more stability, but the .IXIC has historically outperformed it during periods of tech sector strength.

- Dow Jones Industrial Average: The Dow Jones focuses on 30 blue-chip stocks. It’s the most traditional of the major indices, featuring mature companies with less direct tech exposure, leading to less volatility than the .IXIC.

Important Takeaways

- Technology Drives Performance: The .IXIC’s performance largely mirrors the fortunes of the technology sector.

- Volatility vs. Growth Potential: The index’s history demonstrates a pattern of higher volatility than broader market indices, but with the potential for significantly higher growth during tech booms.

- Long-term Perspective: While prone to short-term swings, the .IXIC showcases impressive long-term gains, making it attractive to investors comfortable with risk.

Absolutely! Here’s a breakdown of investing in the NASDAQ Composite Index (.IXIC), focusing on index funds, ETFs, and risk considerations:

Must read: MSN Hotmail Guide

Investing in the .IXIC

The most common way for individual investors to gain exposure to the .IXIC is through investment vehicles that track its performance:

- Index Funds: Mutual funds that passively hold a basket of stocks designed to mirror the composition of the NASDAQ Composite. They offer broad diversification across the tech sector and related industries.

- Exchange-Traded Funds (ETFs): Similar to index funds, but with the added advantage of trading on an exchange like a stock. This provides flexibility, as you can buy or sell ETFs throughout the trading day. Examples of well-known ETFs tracking the .IXIC include QQQ (Invesco QQQ Trust) and ONEQ (Fidelity Nasdaq Composite Index Tracking Stock).

Why Index Funds and ETFs are Popular

- Instant Diversification: One investment gives you exposure to a wide range of companies within the index.

- Low Management Fees: Passive tracking translates to lower costs compared to actively managed funds.

- Accessibility: Both index funds and ETFs are widely available through brokerages and investment platforms.

Considerations of Risk and Volatility

While investing in the .IXIC offers growth potential, understanding the inherent risks is crucial:

- Technology Sector Concentration: The .IXIC’s performance heavily relies on the fortunes of the technology sector. If tech stocks decline broadly, the index is likely to experience downturns.

- Volatility: The .IXIC is known for greater volatility compared to indices like the S&P 500. Sharp price swings, both upwards and downwards, are a characteristic of its history.

- Company-Specific Risk: Even though index funds and ETFs provide diversification, individual companies within the .IXIC can still face unique challenges that can impact overall index performance.

Assessing Your Risk Tolerance

- Long-Term Investors: The .IXIC may be well-suited to investors with a long time horizon and the ability to withstand short-term fluctuations.

- Conservative Investors: If you prioritize stability and preserving capital, the .IXIC might represent a higher-risk portion of a broader portfolio.

- Diversification is Key: Even if you’re bullish on the tech sector, combining .IXIC investment with other asset classes (bonds, real estate, international stocks) helps to mitigate overall risk.

Important Note: Investing in individual stocks listed on the NASDAQ carries even higher individual company risk. This approach requires thorough research and is generally more suitable for experienced investors.

Conclusion

The NASDAQ Composite Index (.IXIC) serves as a vital barometer for the technology sector and a dynamic force within the broader stock market. Its history is a testament to both the risks and remarkable growth potential inherent in a tech-focused investment approach.

Whether you choose to invest through index funds, ETFs, or carefully selected individual stocks, understanding the .IXIC’s composition, historical trends, and risk profile is essential. For investors seeking exposure to the cutting edge of innovation, the NASDAQ Composite Index remains a key player in the ever-evolving investment landscape.