Coverd is a young French company that breathes an air of renewal in the world of insurance for high-tech products. Recently, the start-up has made it possible to insure its MacBook against daily glitches at an advantageous rate given the guarantees offered.

If you’re used to drinking coffee while reading emails on your MacBook in the morning, then you’ve already felt that little moment of sudden dread when you hit the mug near your keyboard. Even though they are quite solid when closed, Apple MacBooks don’t benefit from the same resistance when opened. A fall or spilled liquid can cause serious damage, usually requiring expensive repair.

To avoid these hassles, two solutions: be particularly careful or take out insurance. In the second case, it is necessary to be vigilant on the small lines of the contract. Some insurances like AppleCare + claim large deductibles and restrict the number of repairs. This is not the case with Coverd, the French startup that has entered the world of insurance for portable devices.

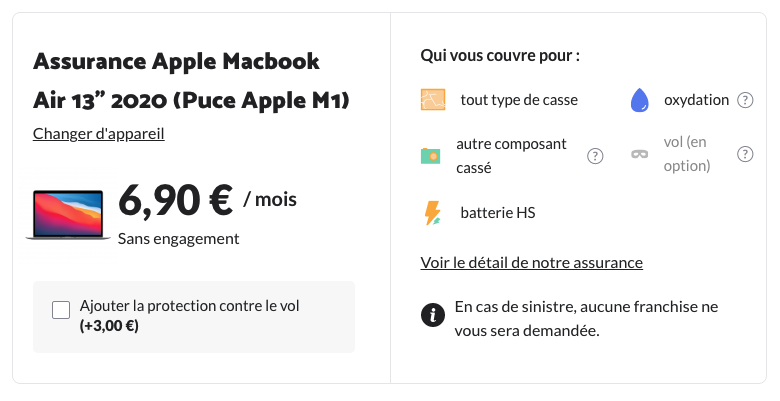

Coverd indeed offers insurance for a wide range of tech products (smartphones, iPad, MacBook), which have the advantage of being easy to understand. There are no hidden charges, and all damages covered by Coverd are displayed explicitly. Above all, Coverd has the advantage of offering attractive prices, given the guarantees offered. In the case of a 2020 MacBook Air M1 for example, Coverd insurance costs only 6.90 euros per month. For older MacBooks, prices start at 3.90 euros. Coverd also offers a month’s subscription to its insurance by entering the code NUMERAMA1M when subscribing.

MacBook Insurance: What Does Coverd Cover?

The first advantage of Coverd insurance is the ease with which you can read its offer. You don’t have to delve into the small lines of the contract to understand if your MacBook will be supported in the event of a drop.

Here’s what Coverd insurance covers:

- damage from any cause, such as a broken screen after a fall;

- oxidation from all causes, like the treacherous cup of coffee that falls on the keyboard;

- batteries, the capacity of which has diminished too much with natural wear and tear.

Above all, Coverd does not ask for any deductible when handling a claim involving a MacBook. This means that Coverd takes care of the repair at no additional cost, even if it involves replacing the computer. The user only has to pay the monthly subscription to enjoy all the benefits of Coverd.

As an option, Coverd also offers coverage against theft. This option is billed at 3 euros per month in the case of a MacBook Air M1 from 2020. It covers your computer against thefts committed by aggression or break-in. Be careful, however, unexplained disappearance and pick-pocketing are not covered by this supplement.

Coverd versus AppleCare +

The apple brand also has its own insurance for MacBook: AppleCare +. This is billed at 199 euros to cover a 2020 MacBook Air M1 for three years, or just over 5.50 euros per month. It’s a little cheaper than Coverd’s insurance for the same device, but it doesn’t offer the same guarantees.

- With AppleCare +, the deductible is 99 euros for repairing damage to the screen, and 259 euros for other types of damage. Coverd does not charge a deductible for MacBooks.

- AppleCare + only covers two incidents per year. Coverd does not apply any restriction at this level.

Importantly, Apple’s insurance can only be purchased within 60 days of purchasing your MacBook. This means that it only concerns new products. In the case of Coverd, insurance can be taken out for new, used, refurbished or even rental MacBooks. You can thus benefit from the Coverd guarantee on your MacBook even if it has already been used for several months.

How Coverd handles claims

The other advantage of Coverd is the ease with which insurance covers claims. Everything is done online, so you don’t have to fill out paperwork and spend long minutes on the phone.

In the event of a claim, the first thing to do is to declare it from your customer area on the Coverd site. The start-up will ask you a few questions in order to determine the cause of the disaster, and the damage to be taken care of. All this happens 100% online, with no application fees or paperwork to fill out.

Once the claim has been validated by Coverd, the insurance undertakes to recover your damaged device within 48 hours, by courier or by carrier. The device is then returned to an Apple-approved repair center. This means that these are original parts that are used to repair the computer, allowing it to keep the manufacturer’s warranty if the device is less than two years old. In cases where the MacBook cannot be repaired, Coverd will replace it with a strictly identical product.

Coverd insures your MacBook from 3.90 euros per month

Already known for its insurance for smartphones and iPads, Coverd now offers you to cover your MacBook. The startup is able to insure many MacBook models, from 2015 to the present day, and for different models and screen sizes: MacBook Pro 13 ″ and 16 ″, MacBook Air and even MacBook 12 ″ which are no longer sold. .

Prices range from 3.90 to 7.90 euros depending on the model, always with additional theft protection. Above all, Coverd’s insurance is non-binding. You can subscribe to the service for several months, then stop your subscription at any time, without having to pay any fees. Finally, Coverd offers a month of coverage to Numerama readers thanks to the code NUMERAMA1M.