Samsung unveils a solution for protecting physical bank cards. Inspired by solutions for smartphones, the system integrates in a single element a fingerprint reader, a processor dedicated to security and a digital safe. If the technology is intended for payment cards, it could also be used for access cards to sensitive areas.

Unfortunately, credit card fraud is not uncommon. Whether with his physical card in a store or with payment information for online purchases. You can have your card stolen of course. A hacker can also steal your card information to sell it on the Dark Web, while others manage to steal a few tens of euros from you by grazing your NFC-enabled card. Fortunately, there are ways to protect your NFC card.

Also read – Mastercard to remove magnetic stripes from its payment cards from 2024

The PIN code also represents a risk. Some users are afraid of losing this code: they therefore write it down in their wallet. The easiest way would be to do without a PIN code. But how to do it ? With the use of a fingerprint reader integrated into the card. MasterCard already offers this kind of technology. But today the system is not necessarily very secure.

Samsung is inspired by smartphones to protect bank cards

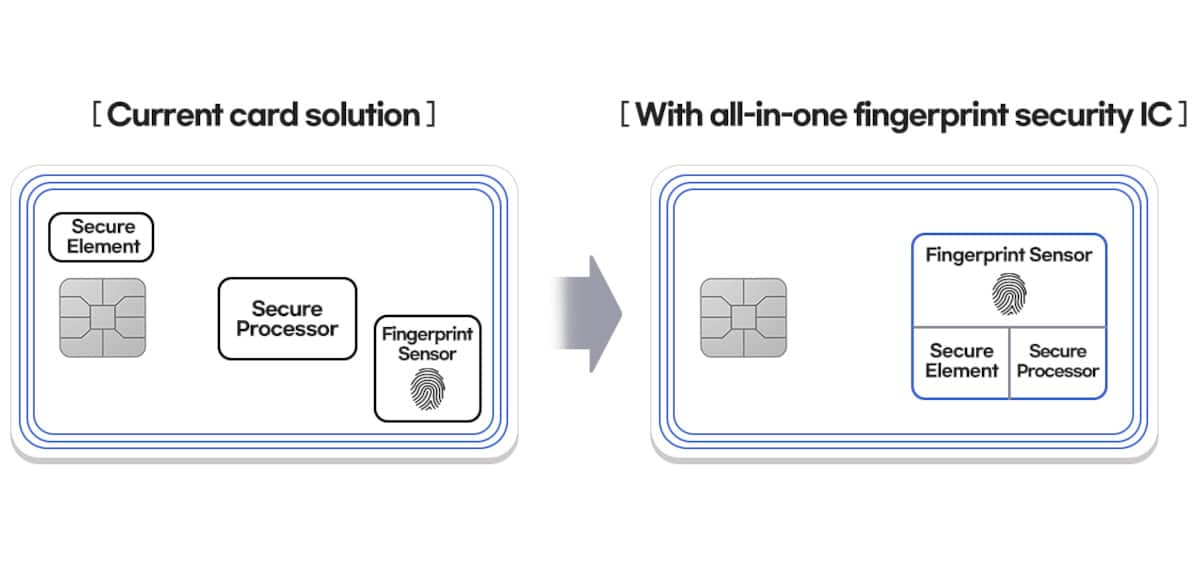

Indeed, the different elements that authenticate the user, the fingerprint reader, the processing processor and the digital safe are physically separated in the card. This represents a security flaw. Samsung presents a credit card protection solution inspired by its work on smartphones. The idea is simple: combine the three system components into an all-in-one solution, a bit like the SoCs of telephones. This reminds us of Knox, Samsung’s digital safe.

The system is called S3B512C. It meets all the security standards in order to be integrated into payment cards, in particular the CC EAL 6+ (standard for evaluating the security of a computer system) and MasterCard BEPS (assessment specific to biometric systems). According to Samsung, this technology is intended for bank cards, but could also find its place in access cards to reserved areas (in companies or administrative buildings, for example).

Samsung does not specify when this solution will land in bank cards. The firm will certainly have to convince banks and card operators. It seems logical to us that MasterCard is the first to adopt it. But Visa could follow if the banks ask for it.