TrendForce forecasts in the server sector for 2023 have changed considerably. This firm is known worldwide as one of the most reliable in its sector, market analysis and forecasts within the technology sector, so all the information that we are going to see below is very reliable, although it is obviously an estimate and therefore it does not have to be fulfilled to the letter.

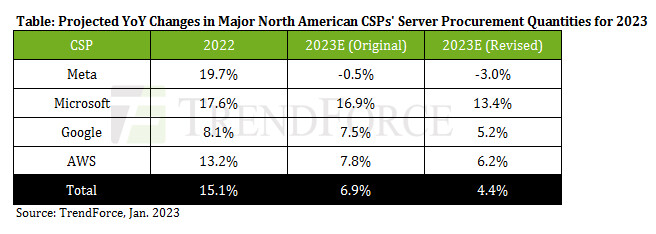

If we look at the attached table, we will realize that the original forecasts for the server sector in 2023 pointed to growth, year on year, of 6.9%. Now. with the latest changes that TrendForce has introduced in its report, we have a 4.4% growth estimate. There is no doubt that this data continues to be positive, especially taking into account the current economic situation at the international level, and that the analysis is limited to four technological giants: Meta, Microsoft, Google and AWS.

However, if we compare the results for 2022, we realize that this estimate actually reflects a major braking, and that in reality it is not as positive data as we might think a priori. These types of slowdowns in growth may be enough for many companies to decide to implement cuts and austerity measures, so we will have to wait and see what happens later this year, if TrendForce’s estimates are confirmed.

Taking a look at the individualized data we see that the most important drop comes from Meta (Facebook), which it will go from 19.7% in 2022 to -3% in 2023. The drop in demand from this giant in 2023 would be enormous, and is a clear reflection that the company is trying to cut costs to a large extent. Microsoft will go from 17.6% to 13.4%, a much more reasonable reduction compared to Meta, and Google will go from 8.1% to 5.2%. For its part, in the case of AWS the drop will be from 13.2 to 6.2%.

In comparative terms, Year-over-year growth in 2022, counting these four giants, was 15.1%, and in 2023 it will drop to 4.4%. These two figures allow us to clearly see the slowdown to which we referred at the beginning of the article, although we will have to wait and see how this affects the adoption rate of the new Intel Sapphire Rapids and AMD EPYC Genoa processors, aimed at the server sector and recently launched as next generation solutions.