The volatility of cryptocurrency prices has generated a lot of interest in stablecoins. We take stock of how these tokens are supposed to be more stable and secure.

In recent months, the volatility of the price of bitcoin has frequently generated confusion and mistrust. The vagaries of the price of cryptocurrencies are now more problematic than ever: the inflation of the price of bitcoin, then the spectacular drop in its value in just a few weeks shows how much crypto values are still unstable. And it is precisely for this reason that stablecoins are more and more talked about.

These “stable tokens”, in French, are a special case in cryptocurrencies. They work, like all the others, on a blockchain. But what is special about them is that their value is not only determined by their popularity, utility or rarity: it is indexed to another element. And, for more and more experts, stablecoins are “the future”.

What is a stablecoin?

Stablecoins are cryptocurrencies whose value is pegged to a fiat currency, such as the dollar or the euro, or to a metal, such as gold or platinum. This peculiarity allows them to avoid significant price fluctuations, as can be experienced by other cryptocurrencies, hence their name of stablecoins. They are thus particularly reassuring for investors, and could be more calmly considered as viable alternatives to fiat currencies thanks to this stability.

There are many stablecoins today, mostly pegged to the dollar (which itself was pegged to gold for a while). The most popular by far is Tether. Launched in 2014, Tether is based on a simple principle. ” Tether are 100% collateralised by our reserves, assures the company. Tether tokens are redeemable for dollars […], with a conversation rate of 1 USDT (Tether token) for 1 dollar “. Concretely, for each Tether created, one dollar was deposited in a bank account managed by Tether. There is, however, a lot of controversy surrounding cryptocurrency, which we’ll cover in another part.

What are the main stablecoins?

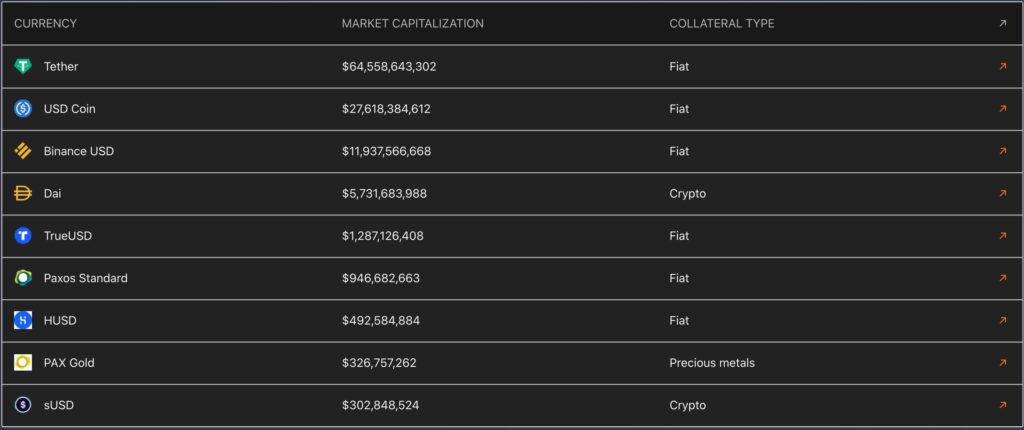

The main stablecoins are pegged to fiat currencies or metals, but there are other kinds of them as well. Here is the list of the main stablecoins:

Stablecoins pegged to the dollar

- Tether (USDT),

- the USD Coin (USDC),

- the TrueUSD (TUSD),

- Binance USD (BUSD),

- the Gemini Dollar (GUSD),

- the Paxos Standard (PAX).

Stablecoins indexed to other fiat currencies

- the Stasis Euro (EURS), indexed to the euro,

- the Euro Tether (EURT), indexed to the euro

- Binance GBP Stable Coin (BGBP), indexed to the pound sterling.

Stablecoins indexed to metals

- CACHE Gold (CACHE), indexed to gold,

- Tether Gold (XAUT), indexed to gold,

- Paxos Gold (PAXG), indexed to gold.

Note also the case of Petro (PRT), issued by Venezuela and indexed to the country’s oil reserves.

Stablecoins indexed to cryptocurrencies

The case of cryptocurrency-indexed stablecoins is peculiar and may seem counterintuitive, given that their success is largely due to their stability. The mechanism to counter their volatility is therefore different from others. For example, the price of DAI is constantly controlled by smart contracts. If the price of DAI fluctuates too much, coins are destroyed in order to stabilize its price.

Stablecoins based on algorithms

Stablecoins indexed on algorithms are still a case in their own right, because they have no collateral, contrary to what one might think. Instead of a dollar or a gram of gold, the stability of the value of these coins is guaranteed by an algorithm and by smart contracts. These manage the number of tokens in circulation. For example, if ” market prices are falling, the algorithm will remove tokens from circulation, explains the specialized site Cryptopedia. Conversely, if the prices increase, the algorithm will decide to produce new tokens in order to dilute their value. It is thus possible that the number of tokens owned by a person changes, but the total value will remain stable, specifies the ethereum site.

The most popular algorithm-based stablecoins are:

- Ampleforth (AMPL),

- Celo Dollars (cUSD),

- and Terra (UST).

How do stablecoins work?

Stablecoins, despite their indexation to external assets, remain classic cryptocurrencies. They are backed by blockchains, whether it’s Binance, Ethereum or their own chain.

They can be used in the same transactions as other cryptocurrencies – stablecoins are particularly appreciated for their stability and by investors in DeFi (decentralized finance) projects. They can more easily be converted back into fiat money, or into gold.

There is no need to mine stablecoins to get them. In the case of Tether, you only need to deposit a dollar to have a USDT. The same for the CACHE Gold: 1g of gold is equivalent to a coin. For other stablecoins, there are different situations. For example, new DAIs are created by users, in exchange for a collateral of their choice.

Are stablecoins decentralized?

This is one of the biggest complaints against stablecoins: they are in some cases centralized. Concretely, this means that an intermediary is necessary during an operation. This is particularly the case for Tether, as it is up to the company to issue tokens in exchange for dollars. This is also the case for stablecoins indexed to metals.

This is the complete opposite of the spirit of cryptocurrencies, which were developed to be decentralized and not require third parties to trade. And that is why these stablecoins are highly criticized in the crypto community.

However, some stablecoins are decentralized: this is particularly the case for those indexed to other cryptocurrencies, or those backed by algorithms.

Why are we talking so much about stablecoins?

The obvious advantage of stablecoins over other cryptocurrencies remains their stability. They benefit from many of the advantages of traditional crypto: exchanges are faster than with traditional banks, and they can be used for decentralized finance projects.

However, some stablecoins have a major problem: their centralized nature, which makes them less secure, less independent and less transparent. And it’s not just that: Since their values remain stable, stablecoins are not a very lucrative investment for stock bettors. Some still have newer protocols, like algorithm-based stablecoins, which can make them unstable, and they’re still quite complex to understand.

But why is everyone interested in stablecoins now? Their volume has more than doubled over the past year, and they now represent a market worth over $ 117 billion. Tether alone accounts for nearly half of that, with the equivalent of over $ 64 billion in circulation.

However, it is precisely partly because of Tether that interest in stablecoins has increased in recent weeks.

What’s going on with Tether?

There are growing concerns about Tether’s fiat currency reserves. Tether ensured that every USDT in circulation had its counterpart in its crates, but that’s actually not entirely accurate. In February 2021, following an investigation, the New York State Attorney stated that “ contrary to Tether’s claims that their virtual currency was fully backed by dollar funds, there were times when this was not the case. “.

A phrase that particularly worried investors, as an insufficient amount of money in Tether’s coffers would mean they couldn’t necessarily get their money back in dollars, and the value of the crypto could potentially crumble.

Tether has denied the prosecutor’s charges, and has since released a report detailing the company’s funds on a quarterly basis. But these reports do not allay all fears. The latest, which was released on June 30, says nearly half of the company’s funds are held in investments and trade debt, and a quarter are in US Treasury bonds (bonds). . The totality of the funds was deemed sufficient for the accountants who audited the funds, but Tether was not very transparent about the debts of which companies it owned.

It was, however, a Bloomberg article, published on July 26, that really caught the general public’s attention to stablecoins. The article revealed that an investigation had been opened against Tether on suspicion of bank fraud. Bloomberg says prosecutors handling the case suspected Tether withheld a number of details from banks in its early days, including the fact that transactions were taking place on the blockchain.

Finally, the fears around Tether’s reserves and the investigation opened against have jostled American financial regulators. US Treasury Secretary Janet Yellen announced in July that she would be taking a close look at stablecoins, in order to make recommendations on possible regulations.