“We are all the Treasury”, said an old institutional campaign, and whether your name is Juan Español or Rubén Doblas, better known as El Rubius, the most successful youtuber in our country, either you keep up with it or most likely, Sooner or later, you will have to be accountable. Whether it is for a few tens of euros in the VAT return, due to an error when consigning a deduction in the personal income tax return or due to the use of what we can call tax engineering to pay less, sooner or later the postman will knock on your door, He will deliver a certified letter and you will know that you now have his full attention.

These types of processes can be resolved quickly, and this is what happens in most cases (especially in those where the amounts claimed by the Tax Agency are lower), but they can take years and are prosecuted. , as has been the case in the confrontation between El Rubius and the Spanish collector as a result of the way in which the youtuber paid taxes for his income in the years 2013 and 2014.

As you may remember, up to that time it was relatively common for recipients of a certain amount of income to choose to pay them through corporation tax, instead of doing so through personal income tax. For this purpose it was necessary to set up a company, but in exchange all income was taxed at a lower rate. According to many sources, there were many advisers who recommended celebrities of all kinds to opt for this model.

Image: The Daily

However, at a certain moment the Tax Agency began to pursue this technique. It became popular to affirm that the AEAT had changed its criteria from one day to the next, while the Agency affirmed that this was not the case, that this fiscal engineering technique was not legal and that, therefore, there had been no change in the norm, if not in the zeal on the part of the Agency to persecute and sanction it. All kinds of celebrities were affected by this tightening of control by the AEAT, even Joaquín Sabina, one of them, dedicated a stanza to the minister of the sector at that time, Cristóbal Montoro, in his autobiographical «I deny it everything”.

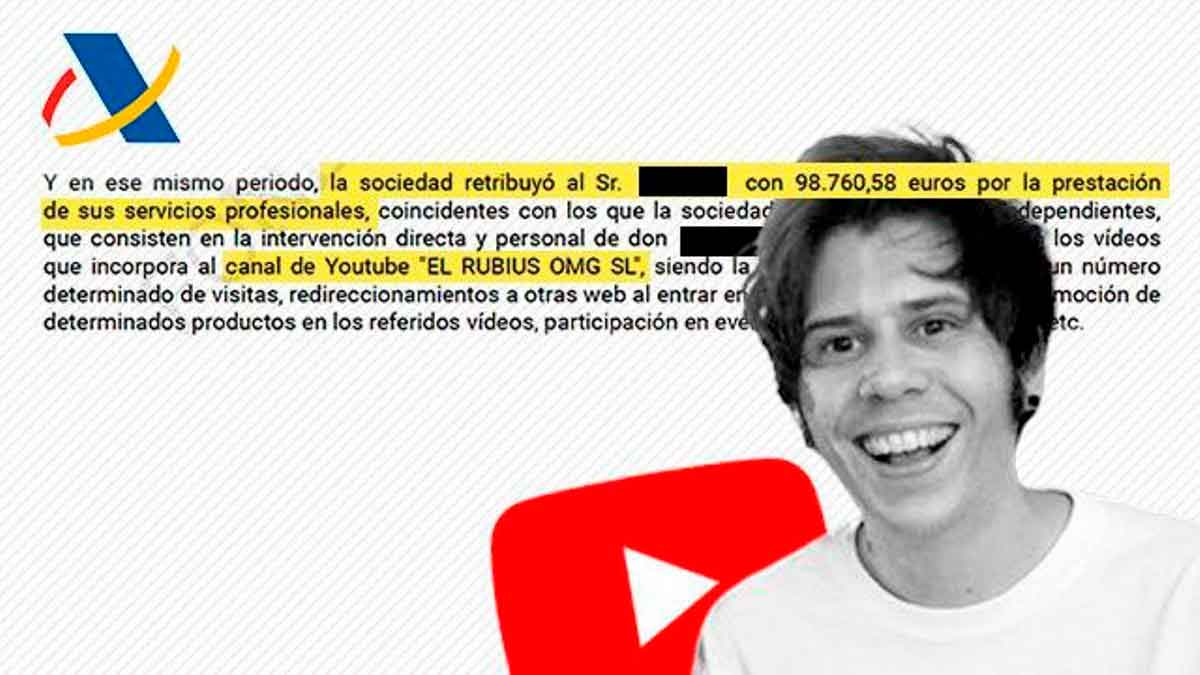

Such is the case of El Rubius that, as we can read in ElDiario, began to be investigated by the Tax Agency in 2015 for paying a large part of their income through corporate tax, despite the fact that the companies used for this purpose, first «El Rubius OMG SL» and later «Snofokk» did not accredit the resources (personal and means) that would justify their use for such an end.

Now, in a sentence that is final, justice has once again agreed with the Tax Agency, imposing on El Rubius the payment of close to 50,000 euros that he stopped paying in 2013 when using the corporate tax formula, and adds a fine of 23,000 euros more for trying to deceive public coffers. In addition, as we can read in that publication, these amounts refer to the 2013 financial year, so we will have to wait to see what happens with 2014, in which he repeated this system to pay taxes on his earnings.