It’s really amazing how the world of semiconductors moves. Only a few days ago the news was released that the number of manufactured chips would increase, which is not new as such since we already talked about it almost a month and a half ago, so this was the confirmation of that for this first trimester. But now the US drops a new bomb that destroys all of the above: there is only chip inventory at 5 days seen.

How is it possible that the main players in the industry call for calm and the United States launches the opposite message today? Well, everything turns to a survey that would have been done from the country of stars and stripes where if we look back we will see the situation in which we find ourselves.

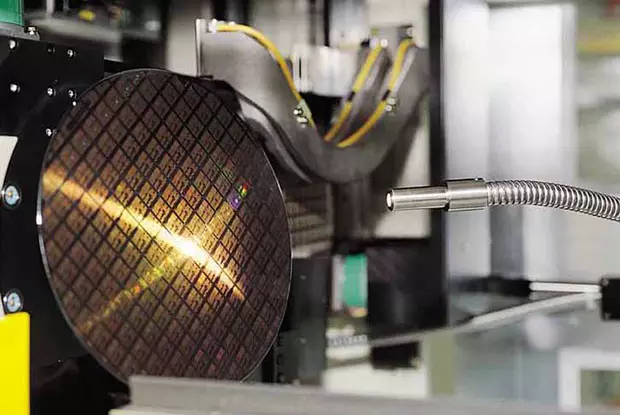

Chip inventory 5 days ahead

The statements of Gina Raimondo, US Secretary of Commerce, are as clear as they are precisely alarming:

“According to a survey conducted by the department approximately 150 companies around the world see manufacturers’ average chip inventory plummeting from a supply of 40 days in 2019 about 5 days at the end of last year.”

What this implies is very simple: the industry is hardly chipped, everything that is manufactured is already sold prior to order and demand continues to far exceed supply. It’s nothing really new, the problem is that it’s another splinter in the wound that makes us remember and be more aware that we are far from being over.

On the other hand, 150 companies involve many players in the sector and although it is true that semiconductors cover a multitude of approaches and needs, those that mainly concern us here have a different fate because unfortunately for the rest of us in computing we have always valued advances and the chips that make the companies that are now under the highest pressure.

NVIDIA, AMD and Intel, rising prices and greater stock

The three main actors do not suffer the same fate as the rest. NVIDIA has already said that in the second quarter there will be about a 15% more graphics cards on the market and that your network of servers and FPGAs will also have more stock. AMD follows a similar trend, although more restrained by “fault” of TSMC.

And it is that it has to put on the market not only more GPUs, but also new products that face Intel, since it is once again at a clear disadvantage with the blue giant in all aspects.

For its part, Intel has been planning the launch of the entire Alder Lake range for almost a year and has hit AMD hard. The availability of its chips seems very good and it will be necessary to see how it faces the launch of ARC Alchemist and its availability, mainly because all eyes, all eyes of the industry and miners are on them. On the other hand, the commitment acquired for its mining ASICs is also high, and it has been quite well received by very strong companies that mine Bitcoin.

Best of all is that in all this problem Intel is showing stock solidity to a greater or lesser extent, it is meeting deadlines and above all it is keeping prices as it said, so its image is improving and performance is doing the rest.

Regarding the semiconductor crisis, it is clear that the industry is not far away, it is still very far from being able to say that it is over, after which it is possible that, as we are seeing after the pandemic, there will be an inflation bias that could translate into in high prices to alleviate the demand that was expected, because another thing is clear: no matter how much market analysts say, said demand won’t last until 2026 or it will increase at the rate they predict. Everything that goes up has to go down…