fake pages

They may also obtain card details when we make a payment at a fake page or who has suffered an attack. What the cybercriminals do is receive all the information that we send and that includes the personal data and the card number when making the payment.

For example, they can impersonate a legitimate website or they can carry out Man-in-the-Middle attacks and, if we browse insecure networks and sites that are not encrypted, they receive everything we are sending. The latter is becoming less common, but there are still sites that do not have encryption.

NFC robbery

Another way they can use to steal money from our card is through a Fraudulent charge by NFC. This happens when they hold a terminal close to the card and we unknowingly make a payment. For example, this can happen if we are walking through a crowded place and we have the card in our pocket.

Again, this is not something usual and it is not easy to happen either. But yes, it is another method that would be possible. When making small payments it is not necessary to enter the PIN, which is why it is enough to bring a terminal closer.

Physical theft or loss

One more way is to directly get hold of the physical card. This can happen if we have lost it or if it has been stolen from us at some point. They would have access to it and be able to use it anywhere, which could cost them money. They could use it in shops, online payments, etc.

Keep in mind that for contactless payments in stores, in many cases it is not necessary to enter a PIN. In addition, when paying online, many times the only thing they ask for is the card number and the security code that appears behind it (which is why it is convenient to delete it).

How to detect card fraud

Now, how can we detect that money has been stolen from us with the card? There are different methods that we can take into account. This way we will know at all times if someone has been able to make a payment with it. A way to take action as soon as possible so that this does not continue.

In-app notification

The first option is through the mobile application. one appears to us notification with each payment what we do This usually takes just a few seconds and we will quickly see the transaction, with the name of the premises, the economic amount, the date and time. This information can already alert us that something is wrong.

This is not something that is present in all bank cards, since it will depend on the bank. In addition, it will be essential that we have the application installed and with our data configured correctly.

Mail or SMS

Another way of knowing how to detect bank card fraud is through a message that reaches us by email or mobile. We can also configure this according to the type of bank we have. Once a payment is made, we will automatically receive that information.

As in the previous case, we will see transaction information such as the establishment where the payment was made, when it was made, the amount, etc. We will be able to be aware of any movement there is.

enter the bank

If all of the above is not possible, we have the option of enter the bank account by Internet. There we will see the extract of all the payments and income of the account. We will be able to detect any anomaly that appears and know if someone has been able to use the card without our permission.

We can also apply this to physically update the bank book. Although it is something that is becoming more and more obsolete, it is still an option to go to any ATM, put the passbook and give it update so that it shows us all the payments made.

What to do if we have been robbed

What if we see that money has actually been stolen from us with the bank card? Then we should take action immediately. We are going to see the main steps that we must take to solve the problem as soon as possible and that it does not go any further.

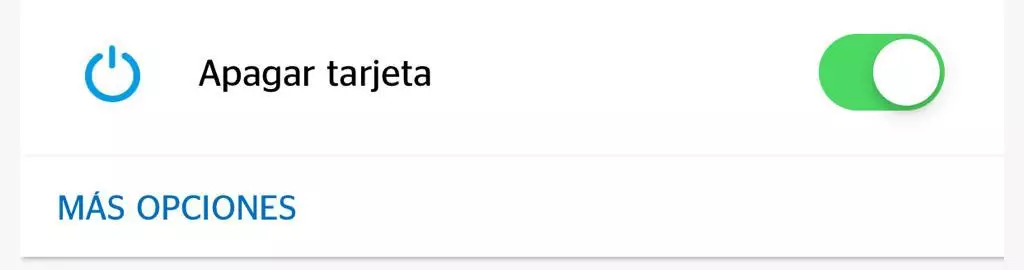

block the card

As soon as we detect any fraudulent payment, we must block the card. For this we will have different options. One of them, the fastest and easiest, is simply to enter the bank application, go to the card section and click on the card to be turned off or blocked. Today most banks have this option. At any time we can activate it again.

Also, a more traditional method is to call the bank. They always have a telephone number that works 24 hours a day and they are in charge of blocking the card if we request it in case of loss or theft.

Investigate what could have happened

The next thing we need to do is investigate how they have been able to steal our card and thus prevent it from happening again. For example, if we have recently made a payment on a web page, our data may have been stolen there. We may have some malware on the system and we have to clean it with the antivirus.

It will also be necessary to investigate whether it could have been a cloning when making a payment in an establishment, if it was only a loose payment and it could have been through the NFC terminal method, etc.

Save all receipts

Another step we must take is to save all receipts. That is to say, any mail where the charge of that fraudulent purchase appears, name of the establishment, etc. We can take screenshots of the mobile application or the bank’s website. That will help us a lot.

Everything we can save will come in handy for future claims and complaints. Luckily, this will be registered in the bank and they themselves can give us an extract with the information at any time.

Make a complaint

One more step is to put the complaint. If we live in a city, we will have to go to the National Police. In case of living in another urban nucleus, we would have to go to the Civil Guard. The complaint is logically free and will be necessary for the next steps we must take.

It is necessary to be able to demand a refund from the bank, to be covered against possible criminal uses (for example, if they use it to buy weapons or anything illegal) or to be able to request damages from responsible third-party companies if, for example, fraudsters have stolen the card for any leak or breach of the GDPR.

However, if the amount defrauded is less than €150, no investigation is opened. If it is higher than that amount, it is usually opened and there should be no problem for our bank to return the amount.

Claim the bank

It is just this step that we have to do next. Must claim the bank, providing in said claim the complaint that we have filed and all the evidence that we may have (the receipts that we have kept, etc.). On their platform they will be able to see all the payments that have been made.

In addition, the bank will issue a new card, with another number. In this way we can continue making our purchases without any risk.

Tips to avoid card theft

After explaining all this, we are going to give a series of tips to prevent this from happening. Although we will never be 100% protected, we will be able to avoid many of the main attacks.

Keep systems always up to date

A very important point is to have the updated and protected systems. Sometimes this type of attack can come after a hacker takes advantage of some vulnerability in our system and thus steals the card data when we make a payment. Therefore, we must have all the patches and updates.

Having a good antivirus can also help us. It is one more way to protect security and be able to eliminate malware that may appear at any given time. This will be very useful to be able to make online payments with greater guarantees.

Use RFID protection

To be protected from the method of card theft via NFC, something very useful is to use RFID protection. We can cover the card with that protection and it will not work even if we put the POS next to it. The same if we buy a portfolio that has this type of protection.

With this we will avoid inadvertently making payments when an attacker passes a POS next to our pocket. When we go to pay, we simply take the card out of the protection and that’s it.

Common sense

On the other hand, common sense will also be essential in these cases. For example, we must not allow the store where we are going to buy to take the card and lose sight of it for a moment. Perhaps they are cloning it and that, later, supposes the theft of money.

We must also have common sense when making online payments. We must always do it on trusted, safe sites, where we really know that there is no risk.

real case

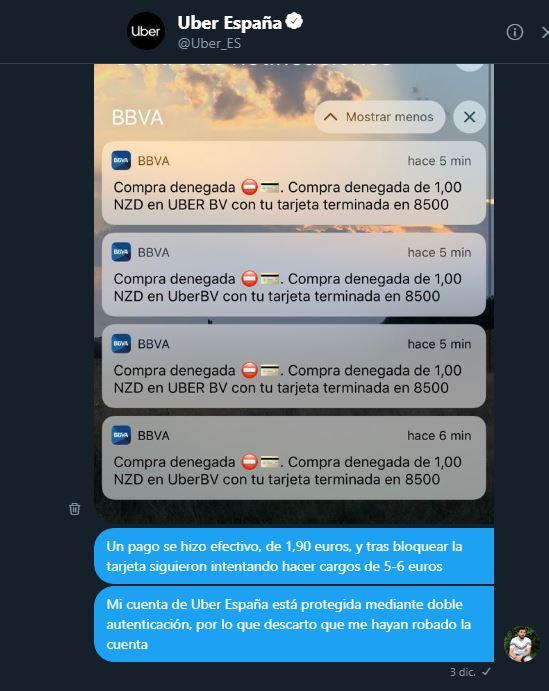

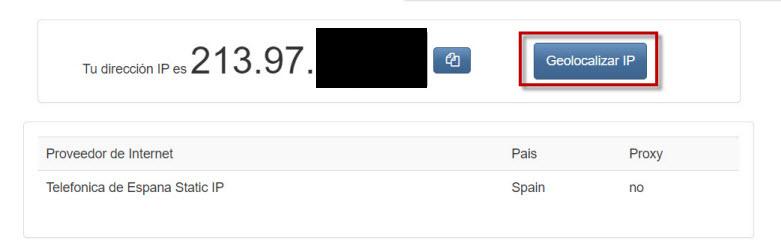

We want to talk about the real case of our colleague Rubén. It happened in December 2018, but it is something that can happen at any time. He started having Uber collection attempts that he hadn’t made. In his case this happened due to bot who try multiple combinations of cards until they find the right one.

What he basically did was follow the steps that we have explained in this article. First, he blocked the card, contacted Uber and the bank, in addition to filing the corresponding complaint.

In that case, much of the blame lay with Uber, since allowed payments without verifying the CVV. In other words, anyone with the card details could pay without having to do anything else. However, there was not a good response from this company, as you can see in the image capture below.

In short, the theft of bank cards is a real problem and it can appear at any time. It is not always the user’s fault, nor is it the bank’s. This can occur due to vulnerabilities in the system, card cloning, etc. We have seen that there are some essential steps that we must take if we are victims of this problem.