There are some banks and bank cards that already require you to activate it. They usually send a code by SMS when making an online payment and that helps to increase protection. But in other cases it must be activated, so it is convenient to review the specific case of each bank and have it well configured.

Install the app from official sources

Of course, another very important point to keep in mind is to install the banking application only from legitimate and safe sources. For example, the official website of the entity or use stores such as Google Play, which filter which applications are going to be there and thus prevent programs created only to steal data from sneaking in.

You should also take this into account when entering the bank’s website or a page where you are going to make a purchase. It is important that you make sure you are accessing the legitimate site and it is not a scam. Your bank details could be compromised if you enter a fake URL, for example.

Activate limits

One option that bank cards have is to be able to set certain limits to avoid fraud. For example, limit the amount you can withdraw from the ATM or the amount you can spend online in a single day. In this way, in the event that someone can steal your data and impersonate your identity, the damage would be less and you would not be able to spend unlimited amounts.

When you go to make a legitimate payment, you can always go into your account and increase that limit momentarily. You can even limit the card so that it cannot be used online and when you are going to use it, you simply activate it for that moment and that’s it. If someone were to steal the card details and use them on the network, they would not be able to carry out any transactions as they are blocked.

Set up alerts

A very interesting way to detect attacks is to configure alerts. You can configure it to send you a mail each time a payment is made with that card or an SMS with the amount you have paid and where. This will allow you to have greater control and be able to identify any attack as soon as possible and take action.

Normally these alerts are configured through the application or website of the bank or card. It depends on each entity, you will find more or less alerts. You can indicate that they send you an email with each payment you make, with transactions only made online, depending on the amount, etc.

General security of the system and equipment

But to use bank cards and pay online in complete safety, it’s not enough just to set up a bank account and use a secure application. It is also essential protect system securityso we are going to give some essential tips that cannot be missed to avoid problems.

protect equipment

The first thing is to properly protect the system. Here you must take into account the importance of having a good antivirus. There are many, both free and paid. A very useful one is Windows’ own, Microsoft Defender. It comes integrated with the system, it’s free and you don’t have to install anything. You just have to check that it works correctly.

But there are many other options, such as Bitdefender or Avast. Whichever you choose, you need to make sure that it is going to adequately protect your system. The objective is to prevent the entry of viruses that may put you at risk when making an online payment or in general when surfing the net.

Keep everything up to date

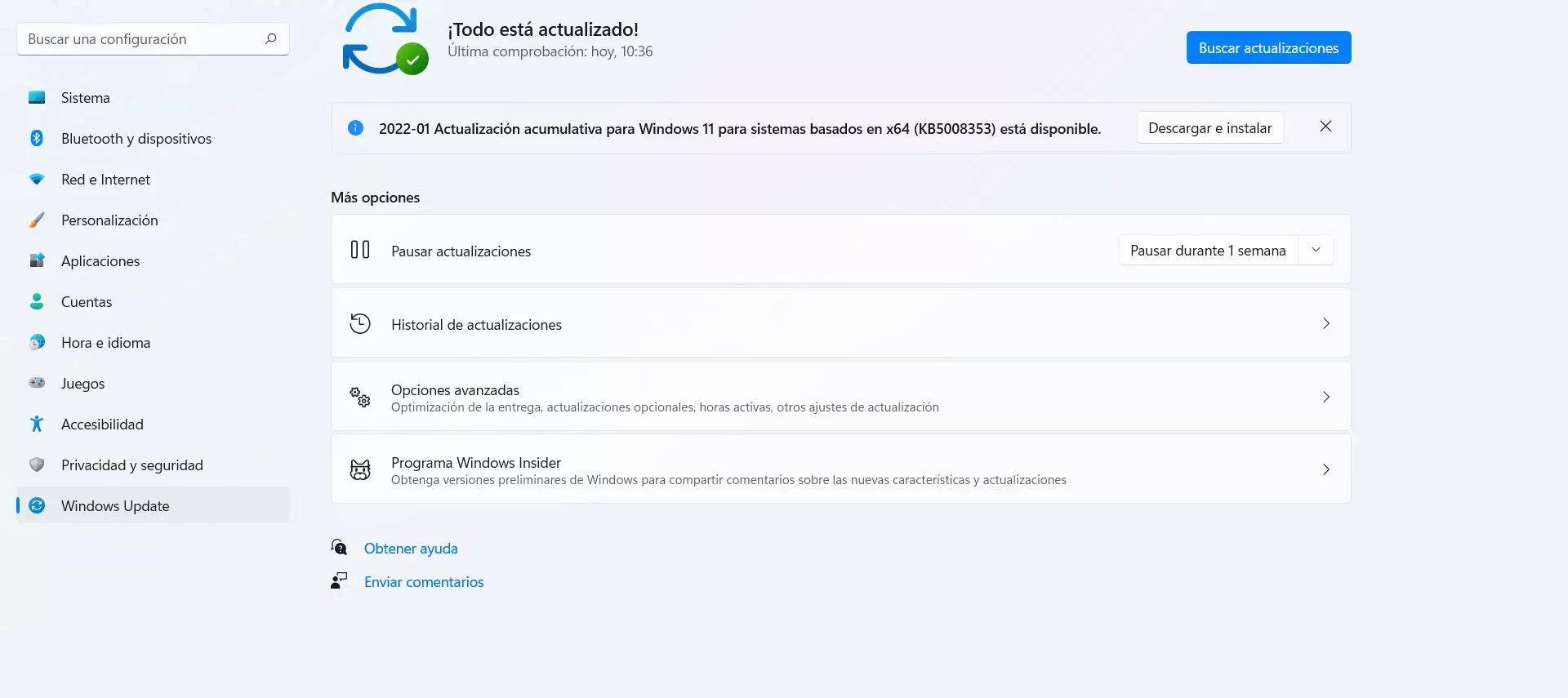

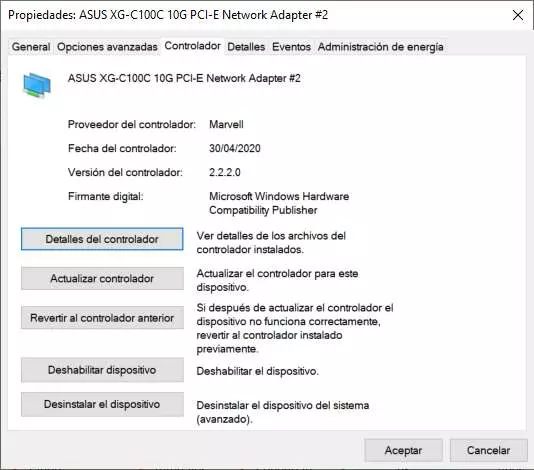

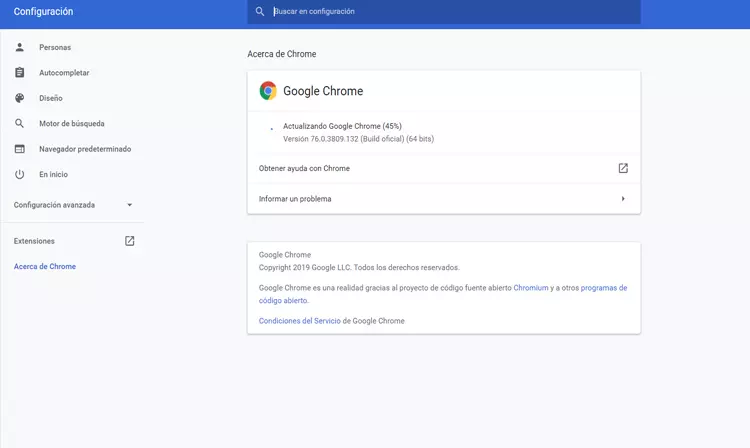

Another very important point is to always have the updated devices correctly. Many types of attacks come after some vulnerability appears. There may be a failure affecting the operating system or any component of the computer. This could lead to the entry of intruders who can steal data and control online payments.

In the case of Windows, to update it you must go to Start, enter Settings and go to Windows Update. There it will show you what version you have installed and whether or not there is any pending update that you can apply.

You must do the same on your mobile or on any device that you are going to use to pay online. You should always make sure you have the latest versions at all times. Keeping equipment in good condition is also achieved through updates and security patches.

Avoid paying on insecure networks

The network from where you connect to pay is going to be essential to be secure. Are you going to connect from a public Wi-Fi network, such as an airport or shopping center? You should avoid such networks as you don’t really know who may be behind it and your data could be compromised.

However, if you have no choice but to make a payment or purchase over public Wi-Fi, our advice is to install a vpn. This will help you encrypt the connection and avoid problems, since your data will go through a kind of tunnel and cannot be intercepted by possible intruders on that network. For example you can use NordVPN or ExpressVPN, which work fine.

Beware of Phishing

One of the most common attacks when paying online or using bank cards is the phishing. It is a method by which hackers seek to steal victims’ passwords. They usually launch a bait through an SMS or email and pretend that it is a real page of the bank or the site where we are going to buy.

However, by putting the data we are actually sending it to a server controlled by the attackers. They usually use strategies such as saying that there is a problem or that you must enter your data to verify that you are really the legitimate user. But it really is a hoax, so common sense is a must here.

Pay only on trusted sites

In this case, common sense also comes into play and avoid making mistakes. It is very important to make purchases or payments only on sites that we see as reliable, that do not pose a problem for our privacy. You should always look at the general appearance, check the urlsee that it is HTTPS, etc.

If at any time you doubt if a site may be a scam, it is best to make sure that it is not before making any transaction. For example, you can perform a search on Google and see what other users think, if there has been a problem or someone says that it is a scam.

In short, these are the main steps you must take to properly protect your bank accounts and be able to buy online with a card in complete safety. The objective is to avoid cyber attacks that could expose your data and for this it is essential to protect the equipment and all its components, as well as the card and bank account itself.