Have you ever wondered how the new kid on the block, the Digital Yuan, is shaking up the age-old credit card game? This dive isn’t just about another digital currency; it’s a journey through its ripple effects on traditional swipes and chips. Prepare for a tale of transformation, challenges, and adaptation in the financial world. Traders and investment education experts offer a unique perspective on how the Digital Yuan is influencing the traditional credit card industry, highlighting the currency’s broader implications. For more insights, visit https://yuanprofit.io/.

The Traditional Credit Card Industry: An Empire Challenged

A Brief History: Credit Cards as Financial Cornerstones

From their inception, credit cards were more than just plastic money; they became a fundamental part of global commerce. Imagine, in 1950, the first universal credit card changed how we view transactions. It transitioned us from cash carriers to card swipers, creating an empire of convenience and debt management. But, as empires rise, they also face challenges.

The Mechanics of Credit: Understanding the Infrastructure and Stakeholders

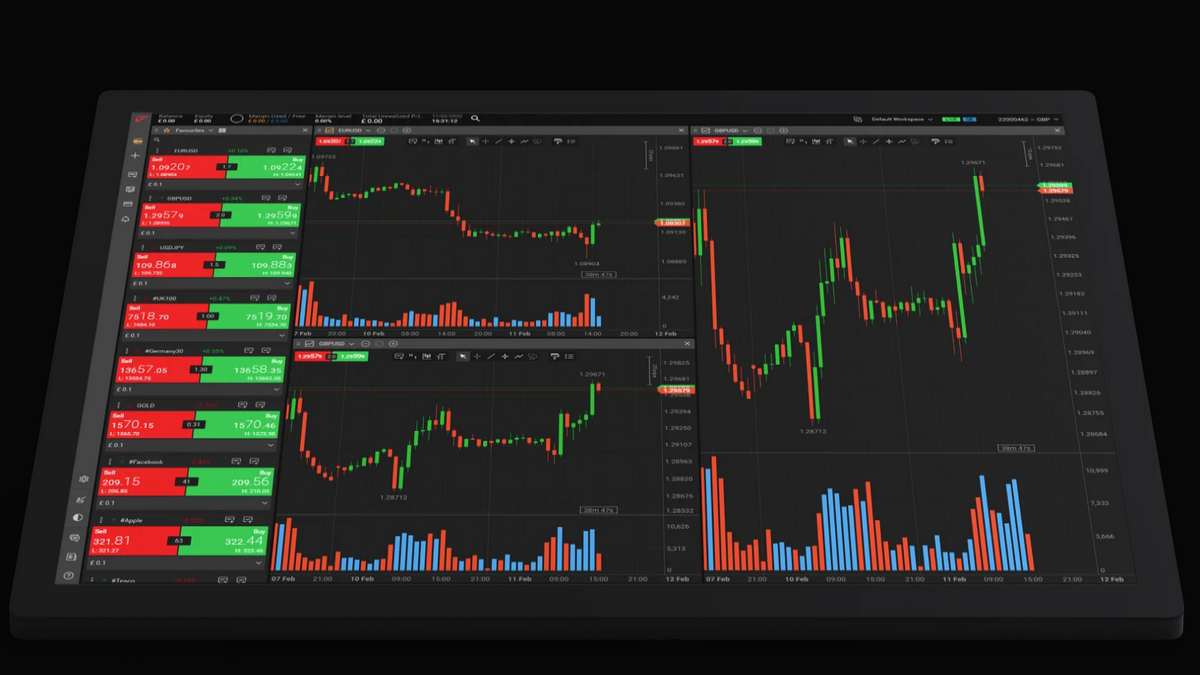

Diving into how credit cards work is like exploring the gears of a clock. Every swipe involves banks, networks, merchants, and, of course, you, the user. Each has a role, from approving transactions to moving money. Yet, this well-oiled machine is now facing the digital age’s new dawn, leading us to wonder: How will it adapt?

The Evolution of Credit Cards: Adapting to a Digital Frontier

Credit cards aren’t just sitting pretty as digital wallets and currencies emerge. They’re evolving and integrating with technology to stay relevant. Think of it as the credit card’s quest for survival, introducing features like contactless payments and security chips to prove it’s not ready to be a relic of the past.

The Intersection: Digital Yuan Meets Traditional Credit

Dissecting the Competitive Landscape: Convenience, Security, and User Experience

When Digital Yuan steps into the ring, it brings a mix of state-backed security and digital ease, challenging credit cards on their home turf. Convenience? Check. Security? Double-check. However, the seamless and integrated user experience might tip the scales. Imagine paying with a tap of your phone, no card in sight.

Transaction Fees and Revenue Models: A Comparative Analysis

Let’s talk about money. Credit cards thrive on fees and interest. Enter Digital Yuan, which lowers costs for merchants and users. This showdown of revenue models might redefine profitability, pushing credit cards to rethink their strategy or risk being sidelined.

The International Dimension: Cross-border Payments and Currency Conversion

Have you ever been annoyed by conversion fees on your travels? The Digital Yuan proposes a streamlined approach, potentially simplifying international transactions. It’s a global handshake that challenges credit cards’ dominance in travel spending. Could this be the push needed for a more unified financial world?

The Ripple Effect: Broader Implications for the Financial Ecosystem

Regulatory Responses and the Global Regulatory Landscape

With Digital Yuan’s entry, regulators worldwide are in a huddle. It’s not just about a new currency; it’s about setting global standards, ensuring security, and fostering innovation. The question isn’t if but how the financial ecosystem will adapt to this seismic shift.

Consumer Behavior: Shifts in Spending, Saving, and Investment Patterns

Digital Yuan isn’t just changing transactions; it’s reshaping how we think about money. With easier access and digital-first approaches, consumers might start viewing spending and saving through a new lens, potentially altering the very fabric of financial habits.

The Future of Banking: Digital Yuan as a Catalyst for Innovation

Banking, meet your digital disruptor. The Digital Yuan pushes banks to innovate beyond traditional models, turning them into tech hubs. It’s a bold new world where your bank evolves to be more than just a place for money but a platform for digital financial services.

The Credit Card Industry’s Countermove

Adaptation Strategies: Embracing Blockchain and Digital Currencies

There will be resistance to the decline of credit cards. By incorporating blockchain, they want to equal the security and effectiveness of Digital Yuan. This represents a turn towards a hybrid future for banking and a way to remain relevant in a world where digital is king.

Collaboration or rivalry? Possible Partnerships between Digital Currencies and Credit Card Companies

When you can work together, why fight? There’s a chance that digital currency and credit card companies may collaborate. Consider it a fusion of innovation and tradition that creates a varied yet cohesive financial scene.

Reimagining Credit Cards through Technology, Incentives, and Client Interaction

Credit cards are redesigned to emphasize technological advancements, improved benefits, and digital user engagement. It’s not just about making a payment; it’s also about delivering an experience, demonstrating that adaptation is essential for survival in the financial industry.

Conclusion

As we wrap up this exploration, it’s clear that the Digital Yuan isn’t just a new player but a catalyst for change in the financial arena. From challenging traditional credit cards to reshaping banking, its impact is profound. But remember, in finance, adaptation is the name of the game. The future? It blends legacy and innovation, marching towards a digital horizon.