This is not the best time to say to buy a house and apply for a mortgage due to the high cost of Euribor, which will directly affect its interests. Obviously all this also affects those who already have a mortgage loan, so let’s see a website that may interest those affected.

Good part of the citizens who have a mortgage loan Right now, they have a variable type, something that perhaps they are now regretting. Surely many of you in the last few months or shortly are going to experience a significant rise due to the aforementioned interests. Many of those who have an adjustable mortgage have an annual review that right now they are fearing in most cases.

Of course, there are different alternative exits to be able to save part of that rise or all of it. you have to They decide to eliminate the mortgage, although for most that is nothing more than a dream. We can also amortize a part of it in order to reduce it and that the rise is not so huge in the review. As you can imagine and surely more than one of you have thought, if you repay part of that mortgage loan, the rise in interest will be less because of the Euribor.

However, paying off part of the mortgage is an important step where a good amount of money is normally invested. Perhaps this is a good time due to the rise in Euribor, but let’s see how we can be sure. And it is that before carrying out an amortization movement like this, there are several factors that we must take into consideration.

Save if you are going to repay the mortgage for the Euribor

In these same lines we are going to talk about what we could consider as a amortization calculator that will help us make the decision. The aforementioned Euribor is changing constantly and lately upwards. Hence, if we are thinking of paying off part of our mortgage to reduce interest and partially alleviate the increase in the monthly payment, we are going to use this simulator that we are talking about.

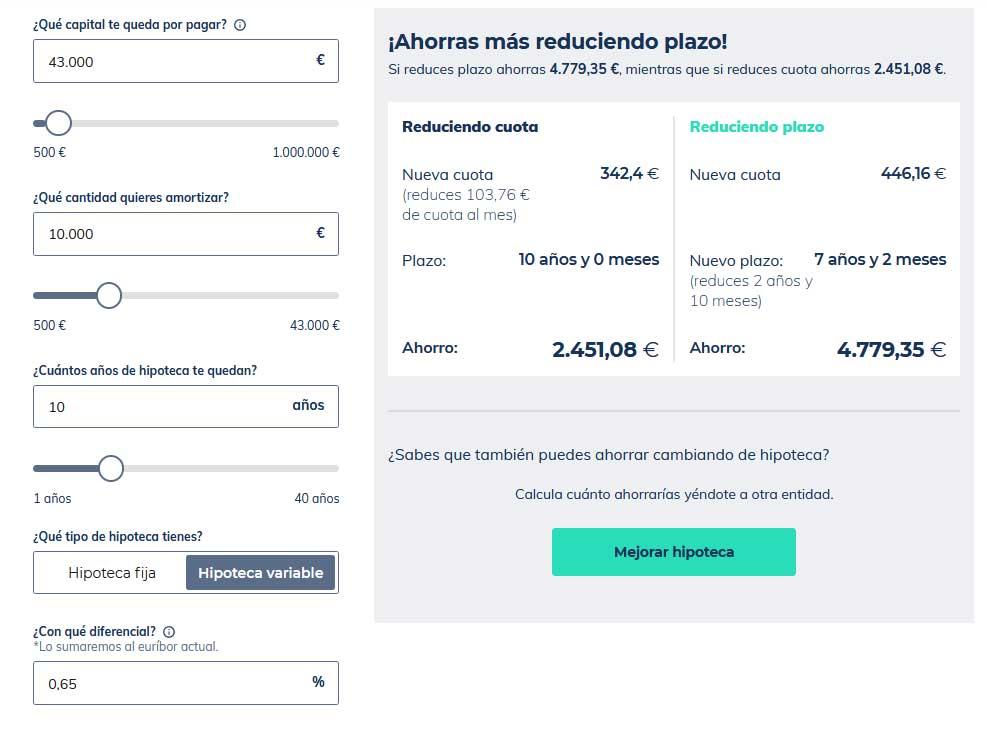

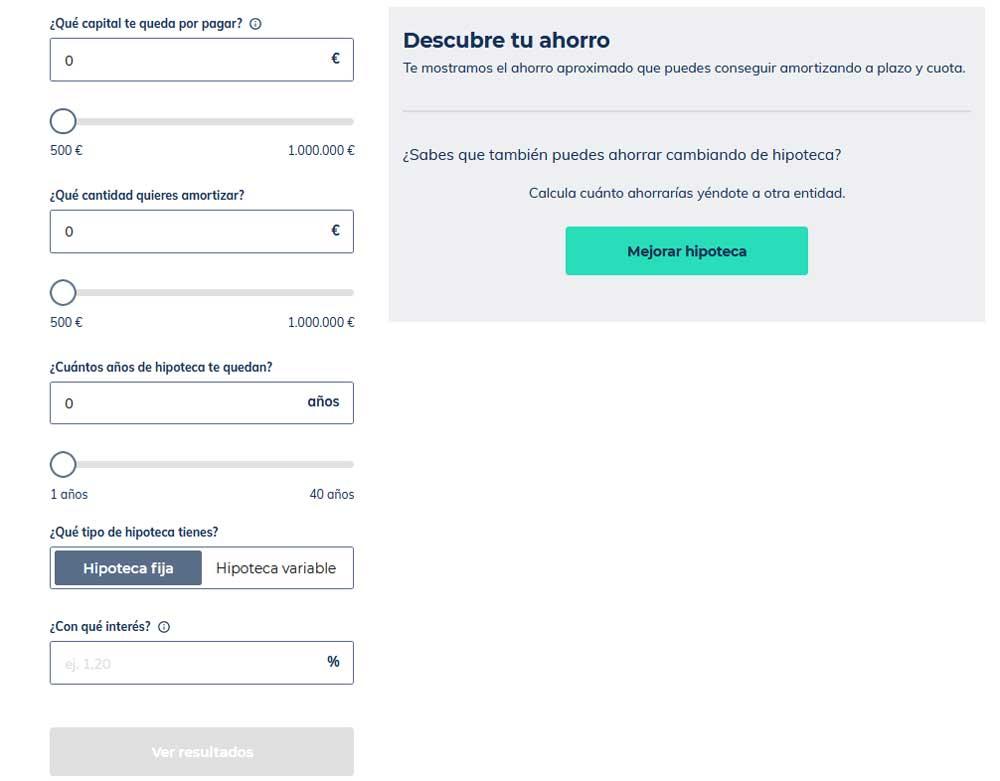

In principle and from our favorite Internet browser, we only have to access this web page. Next, it will request a series of data to carry out the calculation that interests us. We will have to specify the mortgage that remains to be paid, the amount we plan to repaythe remaining years or its type, fixed or variable.

In this way, once we have filled in these fields that we should know, the truth is that they are quite basic, corresponding to our mortgage, we will see the results that interest us now. The simulator shows us the new installment that we would pay with that amortized amount, both reducing the installment and the period of time that we have left.

Obviously this simulation is something that we can carry out as many times as we want and in addition to totally free. This way we will be able to carry out different simulations regarding various amounts of amortization and see first-hand the situation that interests us the most. In this way we will be able to cushion, at least in part, the important rise in the Euribor that we are suffering at the moment.