fintech moon card has raised €37 million in capital from two new high-profile investors, Orange Ventures and Canadian fund Portage, as well as its four previous investors, Aglaé Ventures, Blackfin Capital Partners, Partech Partners and RAISE Ventures.

In a difficult economic context, the financial technology company has completed its Series C financing round thanks to its solid technological and commercial foundations, its client base and its sustainable growth. This round of funding marks the beginning of a new phase in the development of the company.

Mooncard aims to accelerate its development and adaptation to local specificities in 6 European countries (Austria, Belgium, Germany, Spain, Italy and the Netherlands) and strengthen its position to continue providing support to financial decision makers, as its functions become more complicated at the international level.

CFOs, who have a critical strategic role in supporting CEOs, need to go beyond the traditional scope of their role and focus on implementing growth strategies as well as closely monitor expenses to improve the performance and competitiveness of the company. To achieve these objectives, they must simplify internal processes and interact with the different departments of the organization, among others.

Mooncard’s solution fully automates expense processing and expense reporting. More than 6,000 public and private entities have chosen Mooncard. This includes more than 350 accounting firms that recommend the solution to their clients.

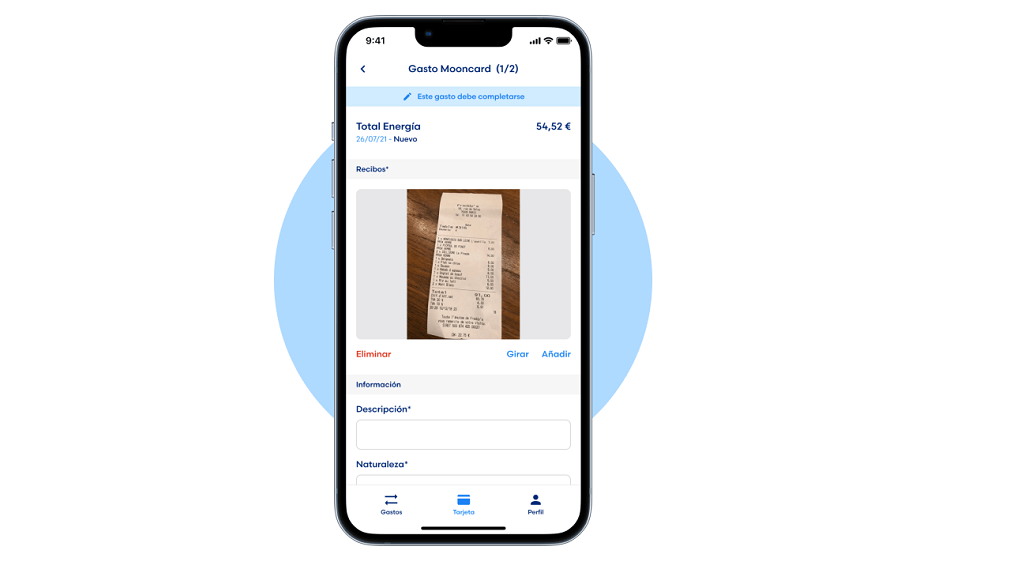

The Mooncard it is a secure Visa card that can be configured for each user or employee profile. For example, it allows you to set daily spending limits, activate spending categories such as restaurants, service areas, or taxis, or disable cash withdrawals, purchases abroad, or online purchases, among others. Likewise, it offers a flexible expense authorization flow (it is possible to customize the number and type of managers that can authorize expenses). In the event of an anomalous request, the person in charge or the administrator may receive an automatic SMS so that they can act immediately. Therefore, the company can offer a card to each of its employees without losing control over expenses. Transactions, which are stored on a secure cloud server, can be viewed in real time. In the case of staff, they benefit from not having to contribute their personal funds to face, in advance, corporate or mobility-related expenses.

Every time an expense is incurred with a Mooncard (a lunch, a taxi ride, a plane ticket, a computer, a software subscription, etc.), the payment data, which cannot be manipulated, are filled automatically and immediately and become an accounting record. The employee will only have to take a photograph of the invoice with his mobile phone to register it, something that has legal value for the responsible tax authorities.

Thanks to the flexibility offered by Mooncard’s configuration and the capacity of its software, this is the only corporate expense management solution that can be adapted to the needs of each client, regardless of the number of cards they have.