That consumer electronics has an increasingly shorter life cycle is a very clear and undeniable fact. Mobile phones no longer last several years and normally, the operational life of a device usually lasts around 2 years maximum. With all this context, it is normal to wonder if it is better to rent or buy an iPhone.

Although the purchase of technology remains entrenched as a reality, every time there are new business models for the consumption of electronics. Is it better to rent or buy an iPhone? We are going to see it together throughout this article.

Is it necessary to buy an iPhone to be able to have one?

As we have said in the introduction, traditionally The first option to be able to use a mobile phone is to buy it. In this way, you make sure that the ownership of the device is yours and that you can also do whatever you want with it, within the limits established by the device’s warranty.

And although this is the most common method of enjoying technology, recently and somewhat hand in hand with the business world, they began to arrive new leasing models that allow the enjoyment of an Apple phone without having to own it:

- Leasing: It is a financial lease of an asset, in our case it would be a telephone, in which a company provides this asset to a client in exchange for a regular payment. The customer does not acquire the phone itself, but while he is paying his fee, he has the right to use it. When the end of the agreement arrives, the client is presented with three options: acquire it at a final price agreed in the contract, return it and terminate the contract, or renew it for a longer period of time.

- leasing: It is a lease contract similar to leasing, which is done in the short or medium term. The big difference with leasing is that not only does the customer get the phone they want, but a number of extra services like maintenance, repairs and insurance also go along with it. In this type of lease the consumer cannot keep the phone and has the obligation to return it at the end of the contract thereof.

- Rent: It is the best-known leasing option, in which a company would give up the use of a telephone it owns to a client in exchange for a monthly payment agreed in the rental contract. In this case the ownership of the phone is never in dispute. (it is always from the company) and once the rental contract is finalized, the user should return the iPhone to the landlord.

Now that we know the three most common lease models, we are going to answer the central question of this article: What is better, rent or buy an iPhone?

Rent or buy an iPhone, that’s the dilemma

Like everything in this life, I believe that the fundamental thing is to do the numbers to know what is the most suitable, but first you should ask yourself a series of key questions that can lead us to think which of the two options is the best:

- Do I always want to go to the last?

- Do mobile phones usually last me long?

- Does my income allow me to pay a fixed monthly fee?

- Do I always need to have the best technology available at the moment?

- When I renew, do I usually sell the old phone?

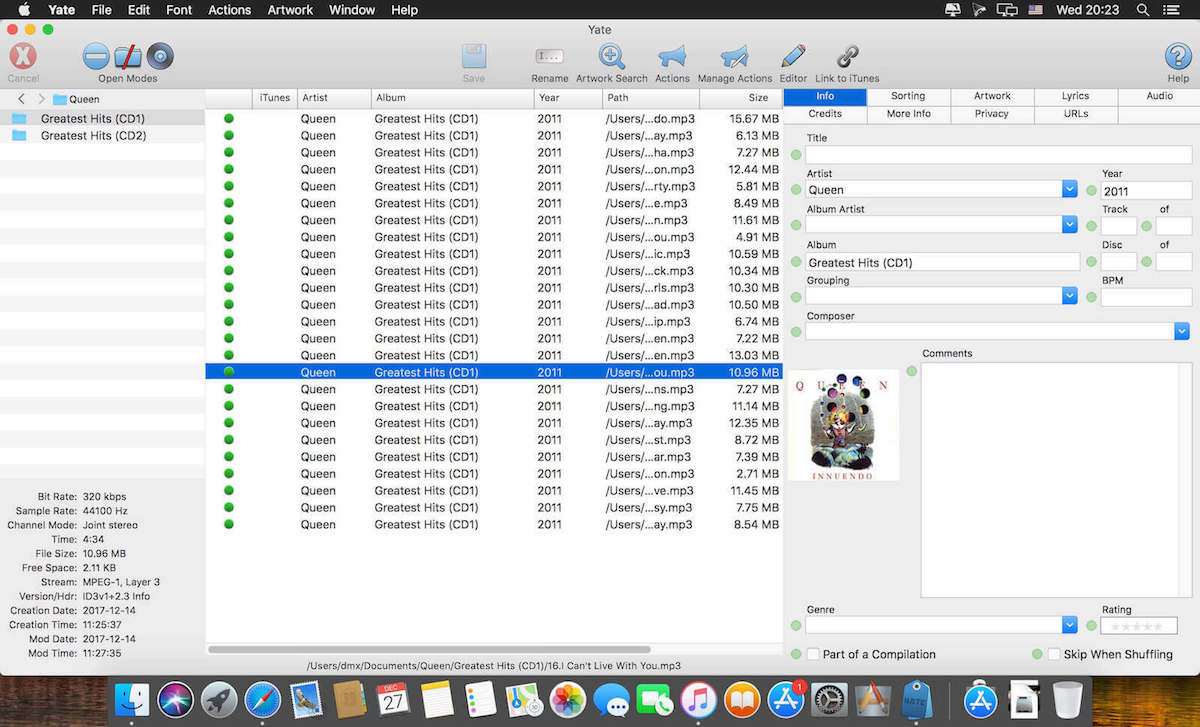

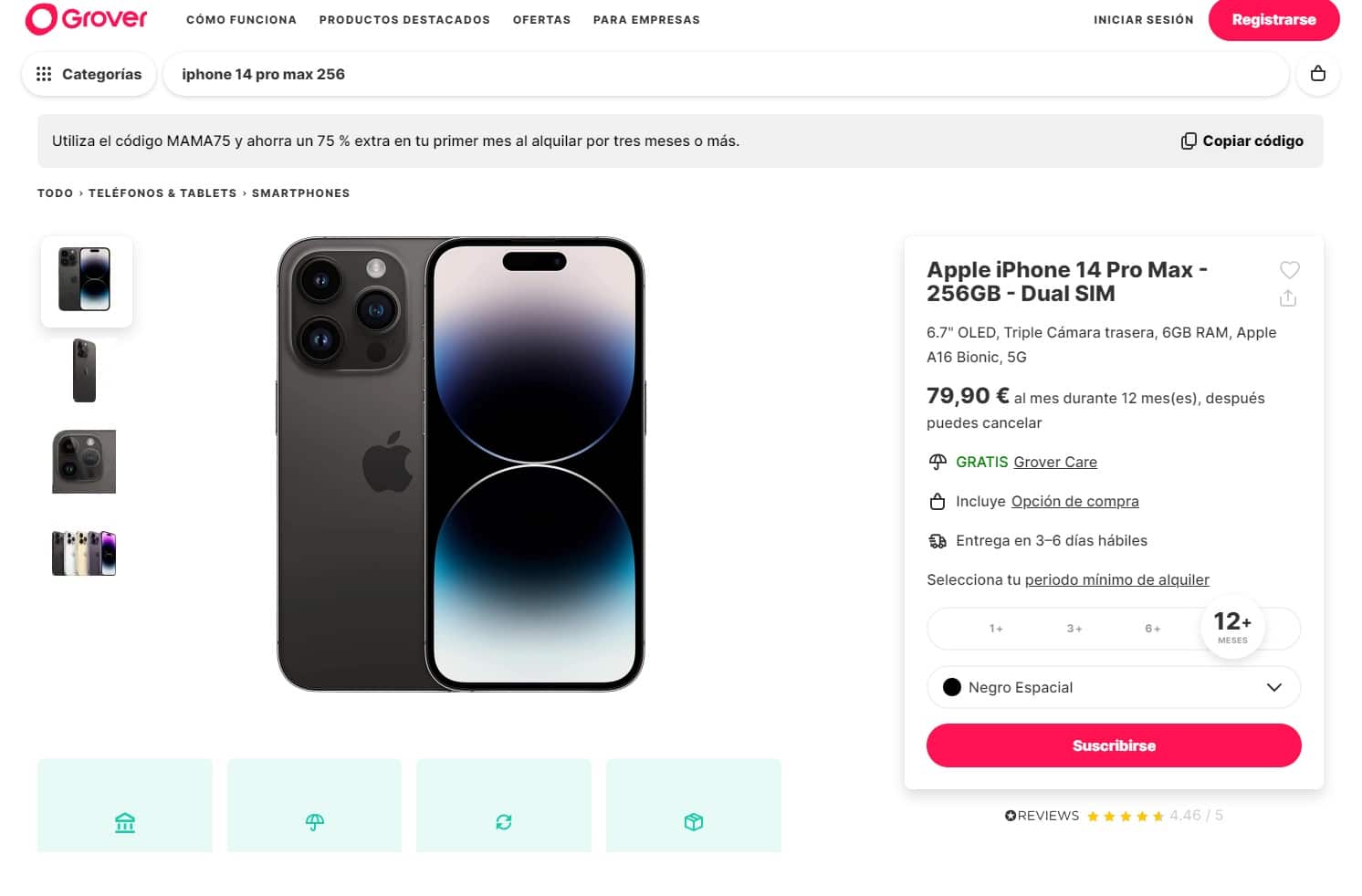

Pretending to rent an iPhone from Grover

Grover It is one of the most recognized platforms in Spain for technology rental: they have everything from household appliances to tablets and telephony.

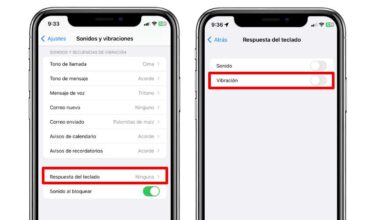

Grover’s conditions along with the rental fee include a insurance with a 10% deductible (that is, in the event of a claim, you only have to pay 10% of the repair), in addition to offering the possibility of ending the contract early or being able to purchase the phone. Therefore, as we saw before, even if they say that they are selling a rental, we could say that we are facing a hybrid between leasing and renting among the services offered by the company.

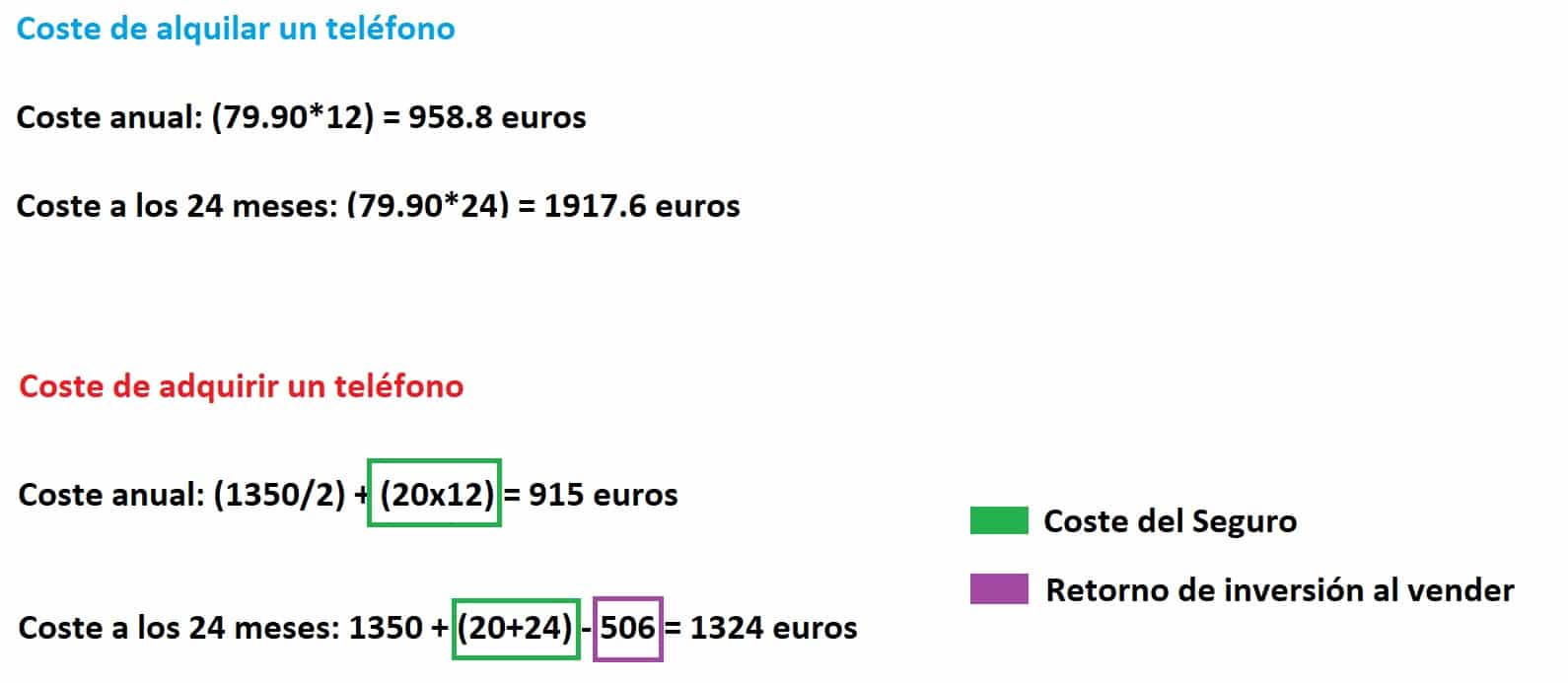

Let’s assume a 12-month lease, which is the maximum time contemplated for a iPhone 14 Pro Max 256 GB. If we review the conditions of the web, it comes out at a price of 79.79 euros per month. Or what is the same, 956.4 euros per yearwith franchise insurance included in the price.

But, although everything looks pretty good on paper, there is a very important risk in this type of business: Grover does not cover theft or loss of the terminal. In the event that your iPhone is lost or stolen, you will need to pay it in full without the fees that you have paid for it serve as a discount, which would greatly trigger the cost of having this model of the Apple brand terminal.

Buy and insure a phone: let’s see the case of financing a mobile

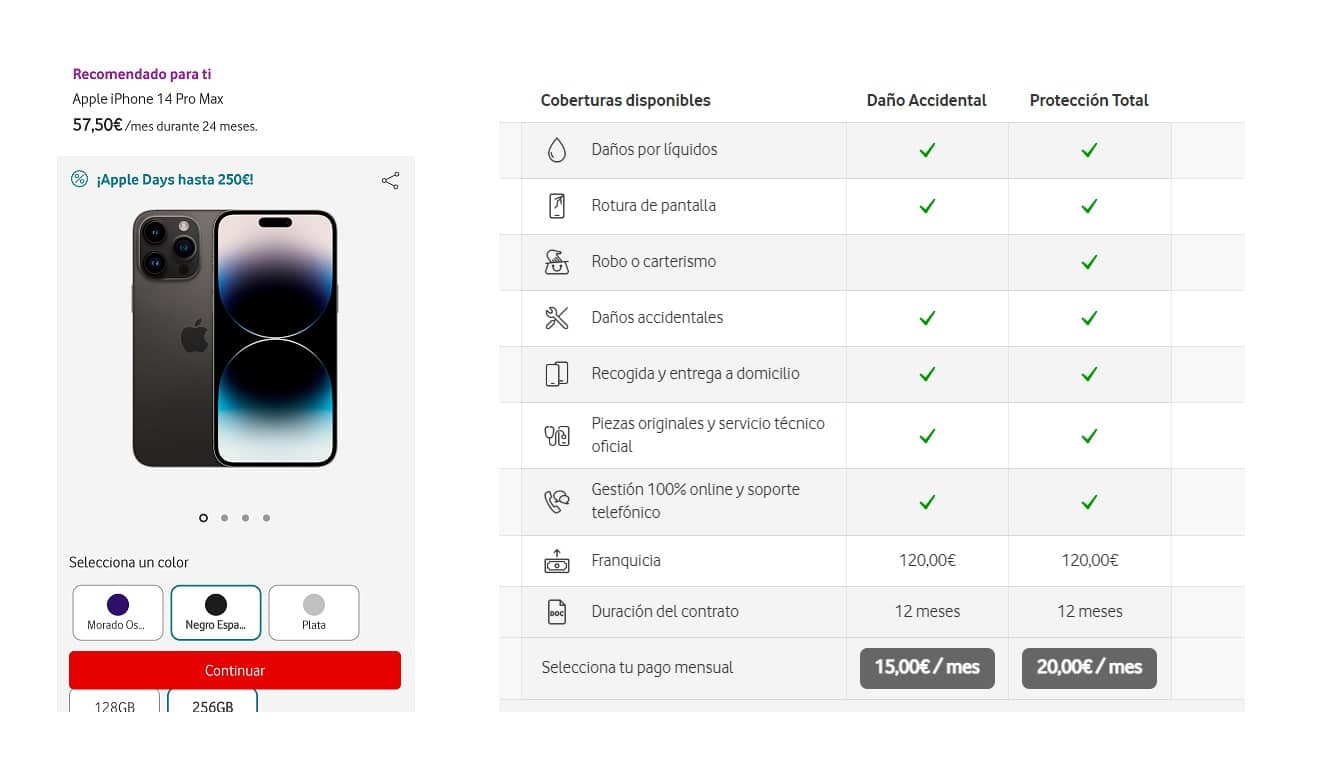

It is difficult to be able to do the exercise of equating both costs since they are very different, but we are going to use the financing of a telephone operator to simulate it. In our case, we have opted for Vodafone since it allows terminals to be financed without having permanence associated with it, in addition to having insurance against breakage and theft called Vodafone Care.

For the same iPhone 14 Pro Max, being a customer with a normal rate with unlimited data, when buying the phone we would have a Retail Price (RRP) of 1380 euros.

Financed in 24 months, there would be a fee of 57.50 per month and if we add the breakage and theft insurance we would add an extra 20 euros. So we would have a quota similar to Grover’s: 77.50 per month.

As a positive point against Grover’s proposal, with the same cost we would own a phone with better insurance: it would cover both theft and incidents with pickpockets (although theft or loss would not be covered), but with the consideration of having the obligation to maintain payment in installments for another 12 months.

But not only this variable must be taken into account when choosing whether to buy or rent an iPhone: if the terminal is your property, when you have paid the installments you can choose to sell it and recover part of the investment. And in the case of Apple, phones don’t lose as much value compared to other manufacturers.

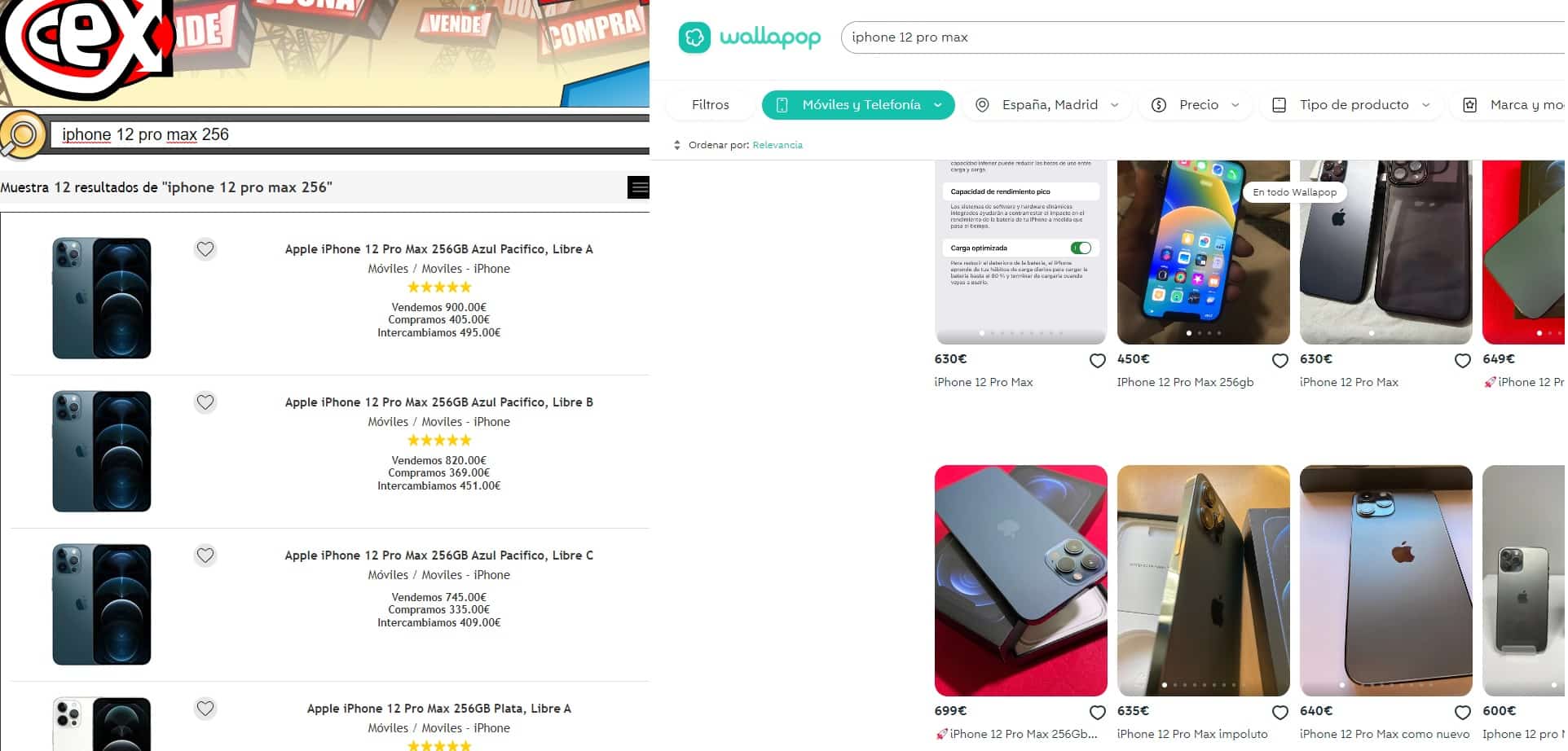

Let’s take as a reference to “predict the future” the most similar iPhone from 2 years ago, the iPhone 12 Pro Max 256 Gb and use CeX as a reference, which from our experience is the second-hand store that pays the best for products:

As of today, May 2023, a 256 Gb iPhone 12 Pro Max in good condition is being bought for 369 euros and if we review second-hand portals such as Wallapop, we can see that it is being sold for around 650 euros. Therefore, if we stay with an average price between both two options, we would be recovering an investment of 509 euros.

With all this, we would have this direct comparison of costs:

Final conclusions: What is better, buying or renting an iPhone?

If we focus on the numbers, the empirical evidence does not lie: it is more profitable to buy the iPhone and enjoy it knowing that we have 100% of the property to rent it, especially since there is a option to recover part of the investment made on the phone than in the cases of an iPhone is important.

But the actual answer is very subjective: It depends on how long you intend to continue with your iPhone. If you only want to use it for a short time like a year or even less, a Grover-type lease could be a good option. (daveseminara.com) In the event that the contract is for two years, do not hesitate: buy your iPhone and you will be making a more reasonable investment.