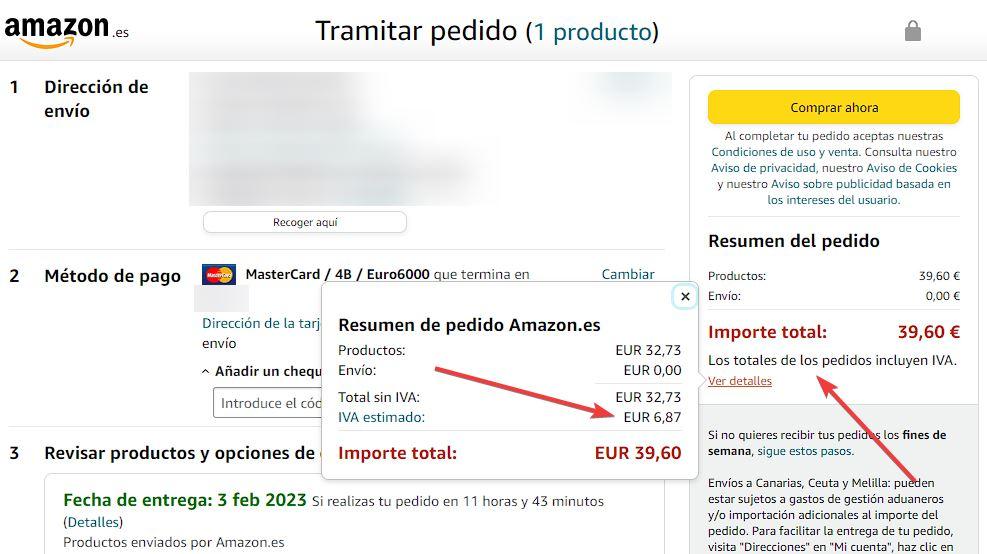

When we buy in a store, online, or any service, in addition to the total price of the product, we are paying the tax known as VAT. Although we generally do not realize it, because it is already included in the final price, this tax is levied on the product at 21% of its base price. Therefore, if we can save us VAT in any purchase means buying with a discount of 21%, and depending on which products the savings is hundreds of euros. And if possible buy on Amazon without paying VAT.

When buying a product on Amazon, the price we see next to it already includes VAT. This means that, yes or yes, we will all pay this tax when we buy at Amazon Spain. If we buy in the store of another country, we will surely end up paying two taxes, that of that country, and also the Customs expenses when processing as imports.

But there are several ways to save the tax. The first one, typical, if we are self-employed or a company and what we buy is to be able to carry out the work, we will be able to deduct VAT. But the number of people who can do it is quite low, it does not apply to everyone. And the Treasury also looks at it with a magnifying glass.

But there are other ways that anyone can buy without having to pay this tax. We are going to explain what we need for it.

Buy on Amazon Spain without VAT

As we have said, Amazon is going to charge us VAT on everything we buy in its store. But if we are only passing through Spain, and we live in another country, it is possible to request a refund of the tax. For this it is necessary:

- Not having Spanish nationality.

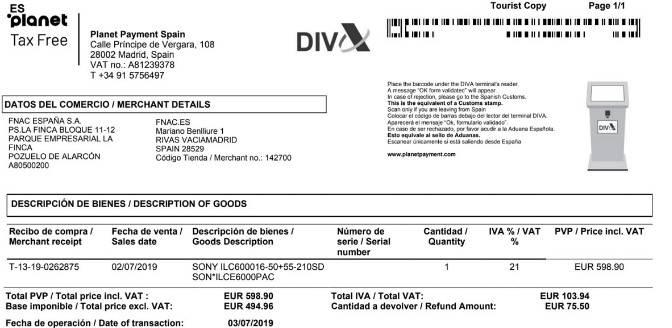

- Make a minimum expense in the country, and have an invoice for everything.

- Ask for a Tax Free invoice in the shops that accept it.

- Being passing through, with a scheduled return ticket.

- The product we have purchased is sealed.

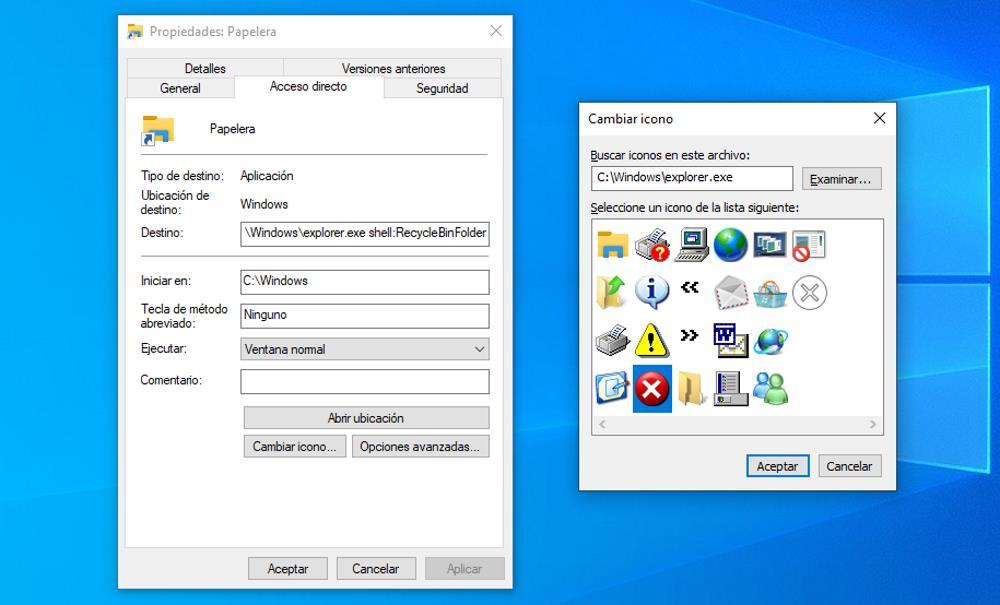

If we meet these conditions, to recover VAT paid on Amazon What we have to do is go to the Tax Free area of the airport and carry out the procedures that are requested to be eligible for a tax refund. After filling out a form, we will have to go to the customs office before invoicing in order to request a refund of the tax we have paid. At the reimbursement office they will return everything to us (except a management fee).

And, of course, residents of Ceuta, Melilla, the Canary Islands, Gibraltar and Andorra can also request a tax refund when buying in our country.

Buy without VAT living in Spain

But, what if we live in Spain? The VAT is going to have to pay us always, there is no way to get rid of this tax. What we can save is the tax if we pay in other countries. The conditions, and the process, are the same. In other words, we have to live in Spain, and be in the other country while passing through, without nationality there, and with a scheduled return ticket.

Again, when we return to Spain we will have to go through the Tax Free area and take the necessary steps to get our money back. The option to buy without taxes is not available for all countries, so we must make sure that the country where we buy is attached to the tax-free program. These countries are:

- South Korea.

- Argentina.

- Ecuador.

- Bahamas.

- USA.

- Mexico.

- Japan.

- Morocco.

- Singapore.

- Israel.

- Turkey.

- Tanzania and Zanzibar.

Non-EU countries in Europe such as Switzerland, Norway and Iceland are also included. The percentage of tax that will be returned to us may vary depending on the country.

Of course, we always run the risk that, even if the country’s tax is returned to us, the customs inspector will force us to pay the VAT on the products to bring them to our country. The same as when packages are stopped at customs when buying from the United States or Chinese stores, but in person.