The startup phenomenon is characterized by being an innovative business model through which emerging companies can become large leading firms. However, the challenge faced by entrepreneurs who want to follow this path of success is not an easy task, and to face it successfully it is essential to take into account two key values: the runway and the burn rate.

In colloquial terms, the runway it is one of the main survival metrics of a company, as it measures the amount of time a company has before it runs out of cash. It is important to continuously monitor this parameter in order to finance the company itself, which becomes the most important requirement when starting a business. So much so that, according to data provided by Spain Startup, only one in ten companies is still operating after three years due, in part, to to lack of funding.

For startups, it is important to take into account how this parameter is calculated, which is generally measured in months, and for this they need to be aware of the cash available and the money they spend each month, which is known as burn rate. In this way, subtracting the final balance from the initial balance and dividing it by the number of months, this value is obtained, which indicates how long a business has before it runs out of credit. Agicap, an as-a-service treasury solution, provides its clients with an automated, real-time view of their cash flow. In order to do so, focus on analysis and make decisions based on your cash position.

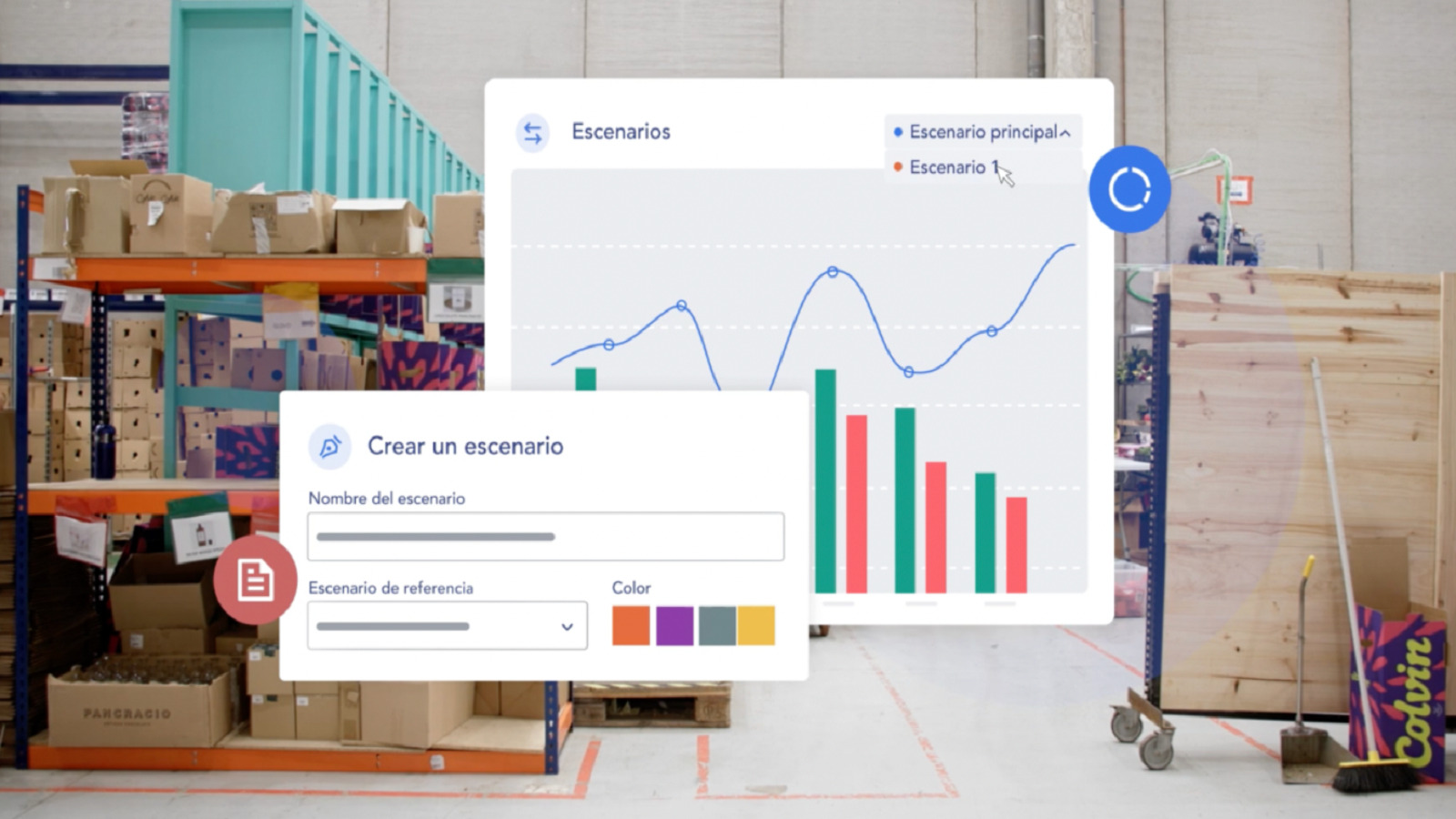

To achieve this end, Agicap offers a dynamic treasury control tool that allows building a reliable forecast base and that help companies that want to take off Set goals quickly and easily. One of the main advantages it offers is that it allows you to create scenarios that simulate the impact on the treasury of possible investments, hiring, drop in business volume… In this way, startups have a resource available that allows them to control management metrics of the money and know when they should raise a new round of financing.

A great example of this is the success story of Colvin, one of the startups that manages its cash flow with Agicap and that has not stopped growing since it opted to digitize its business model. “In a startup, one of the most important indicators is cash burn and thanks to Agicap we can quickly have the result of this indicator month by month and compare it with previous months”, says Laura Mendoza, Treasure Lead at Colvin.