Two days ago we confirmed what was already an open secret: due to pressure from the various regulars, Nvidia decided to definitively abandon the purchase of ARM. And as expected, the failure of the operation has had consequences for all parties involved.

For Nvidia, that despite being «will save» 66,000 million in this operation, will have to pay $1.25 billion to SoftBank not to go ahead with the acquisition. But beyond this penalty, it does not seem that the fiasco will compromise the company’s position neither in the data center nor in the mobile segment.

The multinational actually announced last year the launch of “Grace”, a CPU for servers based on the ARM Neoverse design and this is not going to change. In fact, announcing the launch of the new chip months before the acquisition operation was approved was a way of transmitting confidence to the market; a way of indicating “this is our roadmap and we are serious”.

ARM’s solo path

More curves are coming in the future from ARM. At the moment the CEO of the company, simon segarshas resigned and has been replaced by René Haasresponsible for Intellectual Property (IP) of the company.

In the short term, the company for which Softbank paid 31.4 billion dollars is planning to debut on the stock market, thus becoming the largest IPO in history for a chip company, if we take into account that its current valuation exceeds 60,000 million euros.

The stock market adventure for ARM should also not present too many obstacles. The multinational is the clear dominator of the IoT and mobile markets, with hardly any competition. Only RISC-V could become a competitor in the future, but nothing to worry about in the coming years.

However, if we examine the documents that the company presented last December to the British regulator, it seems clear that ARM sees the situation from a somewhat different perspective, in which starting from a mobile market that is already saturated, entering others such as servers or PCs, it’s not going to be easy.

Medium-term challenges

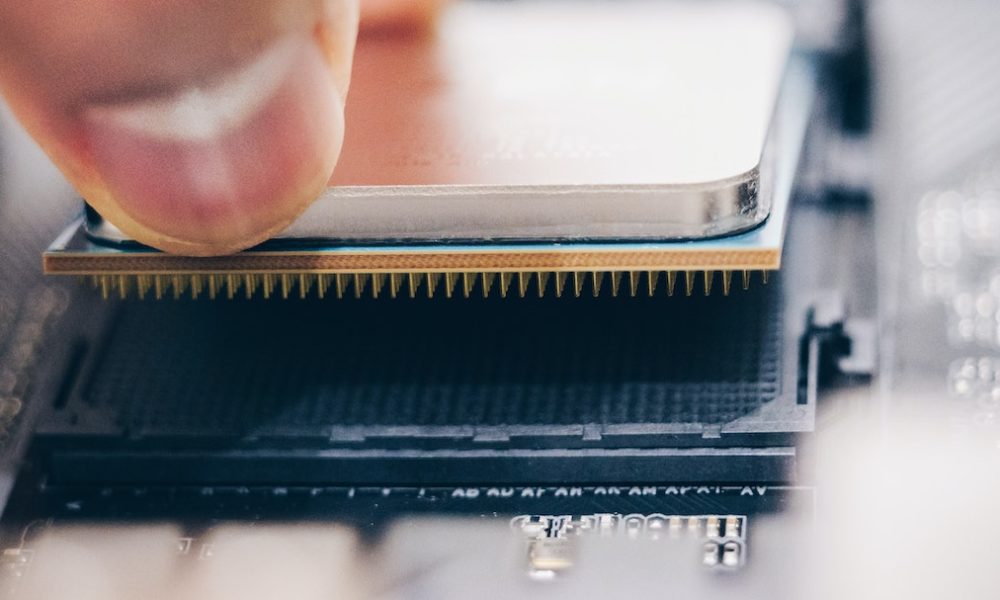

First of all, because server vendors tend to be conservative, and although ARM has demonstrated its ability in this field, most manufacturers rely on Intel and AMD as their main partners when it comes to reaching companies.

On the other hand, ARM points out that the success of companies like Apple and Amazon does not necessarily benefit ARM itself. Many of the most successful implementations of ARM have architecture licenses, not intellectual property licenses. The CPU cores of an iPhone, for example, are compatible with the ARMv8 ISA, but are built on Apple’s intellectual property. And of course, Apple doesn’t bring any design elements from its A- or M-series chips to ARM for inclusion in the next generation of Cortex CPUs. In addition, ARM is also concerned about its ability to retain top engineers in the face of stiff competition from some of its own customers (Apple again, but also other companies like Samsung), not to mention Intel and AMD.

So the big question that seems like the company is going to have to ask itself is that considering that its designs are present in billions of mobile and IoT devices around the world, is if it really should try to conquer the data center and the desktop (fighting the x86 architecture) or focus on what you do best.

Since 2018, the company has been marketing its data center designs under the Neoverse brand. And CPUs like the Neoverse N1 and Neoverse N2 are present in the data centers of companies like Amazon, so it doesn’t look like it’s going to give up trying just yet, as much as the presentation suggests there might be some divestments in this field.