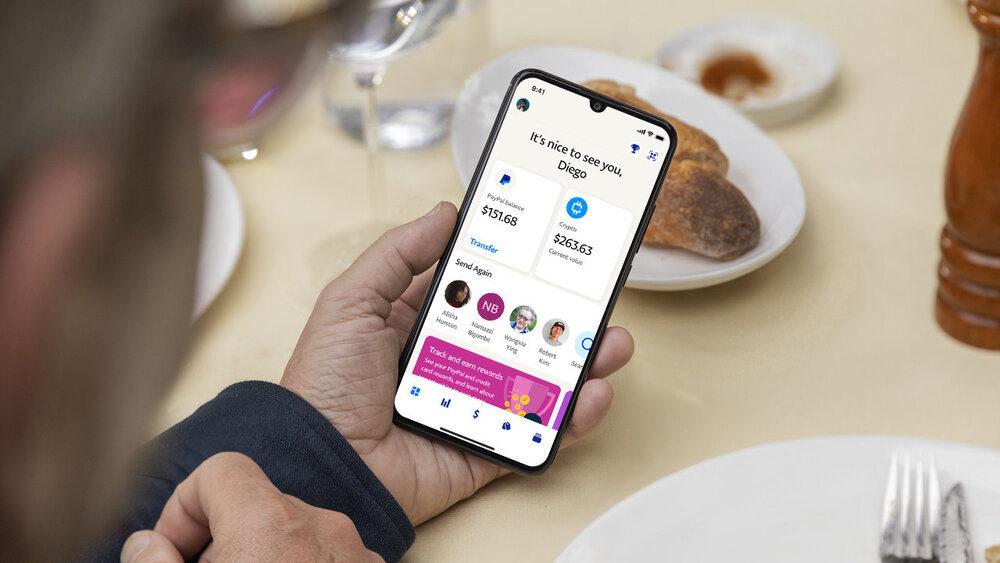

PayPal is at the moment negotiating the purchase of Pinterest for about 45,000 million dollars, 26% more than what it is currently worth on the stock market, and that would imply a payment per share of the company of about 70 dollars. This is stated in Bloomberg, where they point out that PayPal approached Pinterest not long ago to discuss a possible agreement between the two, and that they have been negotiating since then.

PayPal, which is more than 20 years old, has several companies that it has acquired over the years, including the mobile payments Venmo and the Honey coupon and code tool. In addition, last month it reached an agreement to purchase the Japanese company Paidy, dedicated to services that allow you to buy a product and pay for it in installments or later.

For its part, Pinterest, which has 454 million active monthly users, is taking its first steps in the field of electronic commerce, with the launch of Idea pins, through which you can make purchases, and various functions of you buy this month, as a verified seller program.

An agreement of this magnitude, if produced, would mean the largest PayPal purchase in its history, which until now was the aforementioned Honey, for which it paid 4,000 million dollars, and would thus continue the path opened by its CEO, Dan Schulman, of becoming a company not only of payments and collections, but also of purchases. In addition, the company has plans to add several new services to its app, among which there are savings accounts, cash verification or investment possibilities in shares.

PayPal’s interest in Pinterest comes amid a difficult situation for the social network, which announced this month that Evan Sharp, one of its founders, who was in charge of overseeing its design and product teams, is going to leave his Market Stall. In addition, he has had to face several accusations from former employees of discrimination towards their employees. It went public in 2019 with an initial offering that valued it at about $ 10 billion. Since then the price of its securities has risen to a market valuation of $ 40 billion.

From Bloomberg they warn that the negotiations that are taking place do not guarantee that a purchase agreement will be reached. In addition, if it occurs, the terms of the purchase could vary with respect to those that are currently being considered.