Seagate, Toshiba and Western Digital are currently the top three hard drive manufacturers in the industry, and between the three they account for virtually all hard drives manufactured. The industry of mechanical hard drives seemed destined to disappear a few years ago, but it seems that circumstances have made the situation quite the opposite and, as we have advanced before, they have just broken a historical record of sent capacity.

The largest capacity in hard drive history

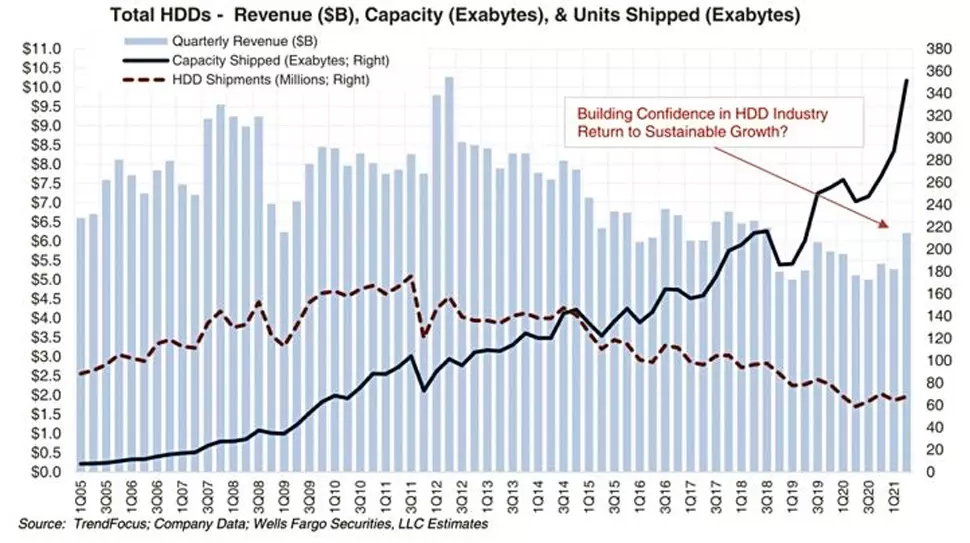

Among the top three hard drive manufacturers sold 67.6 million units during the second quarter, 19 million of which were business-class, according to TrendFocus data. You can see in the graph above that in terms of the number of units sold, they are well below previous years, as the maximum was reached in the third quarter of 2011 with more than 180 million units sold.

Although the number of units shipped is greater than during the last quarter, it is far from the historical record, but the interesting thing about this news is to see the accumulated capacity and, above all, the trend in the graph (the black line). The total capacity of hard drives supplied during the past quarter amounts to 351.4 EB (Exobytes), 45% more than in the same period last year and 22% more than the previous quarter. A decade ago, when the unit sales record was broken, this figure was around 100 EB, 3.5 times less.

Enterprise-grade and high-end high-capacity drives (with an average capacity of around 12.8 TB) accounted for a total of 243 EBs, thus the capacity of the remaining 48.6 million drives for the segment of customer amounted to 108.4 EB (giving us an average capacity of 2.33 TB). Meanwhile, the capacity of an average hard drive amounted to 5.45 TB in this second quarter of 2021.

High-end hard drives for demanding and business applications helped greatly increase revenues for Seagate, Toshiba and Western Digital. As demand for hard drives is falling due to competition from SSDs, the revenues of these three companies fell between $ 8 billion and $ 9 billion per quarter (ten years ago it was 5.5 billion) and still due to the extraordinary demand that we are seeing in recent times, sales during this quarter have represented a total of 6,200 million in revenue, 20% more than in the same period last year.

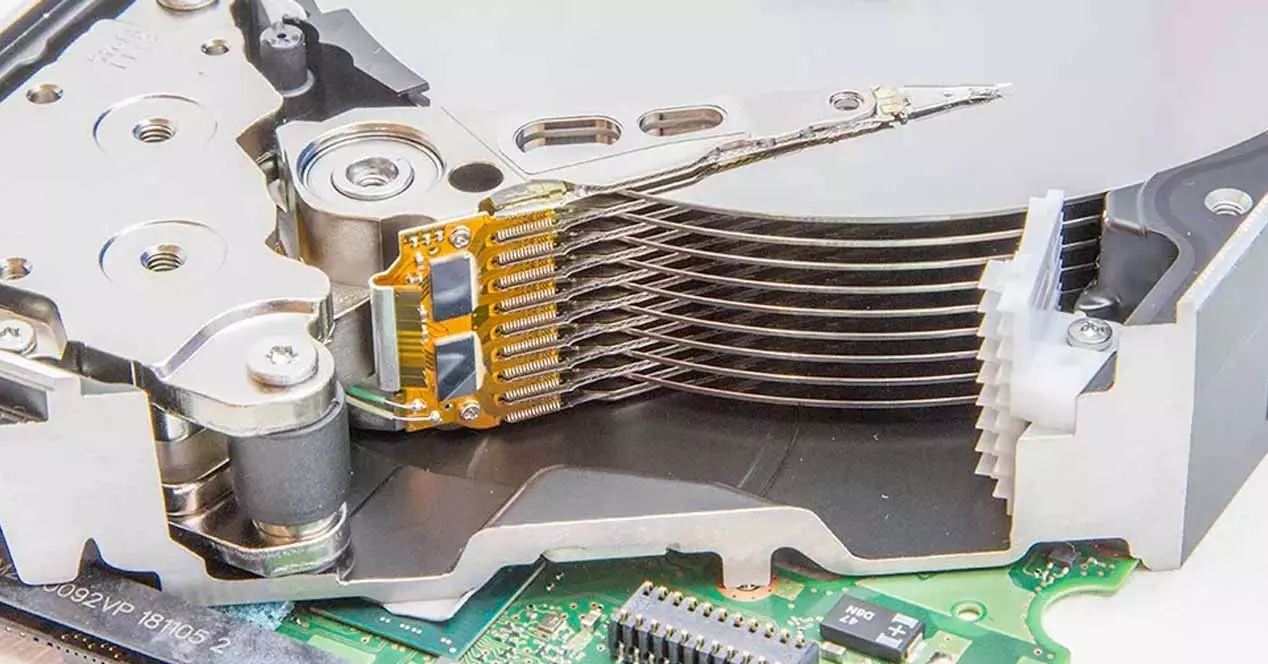

This means that the mechanical hard drive industry is far from dead or gone, and what’s more, it looks like it’s reliving a sweet time. Manufacturers, who at no time have stopped developing new technologies, are finally seeing the fruits of their efforts and investments and if five years ago it was predicted that hard drives could disappear altogether in favor of SDDs, now is that moment it seems more distant than ever due to the good health that this industry now enjoys.